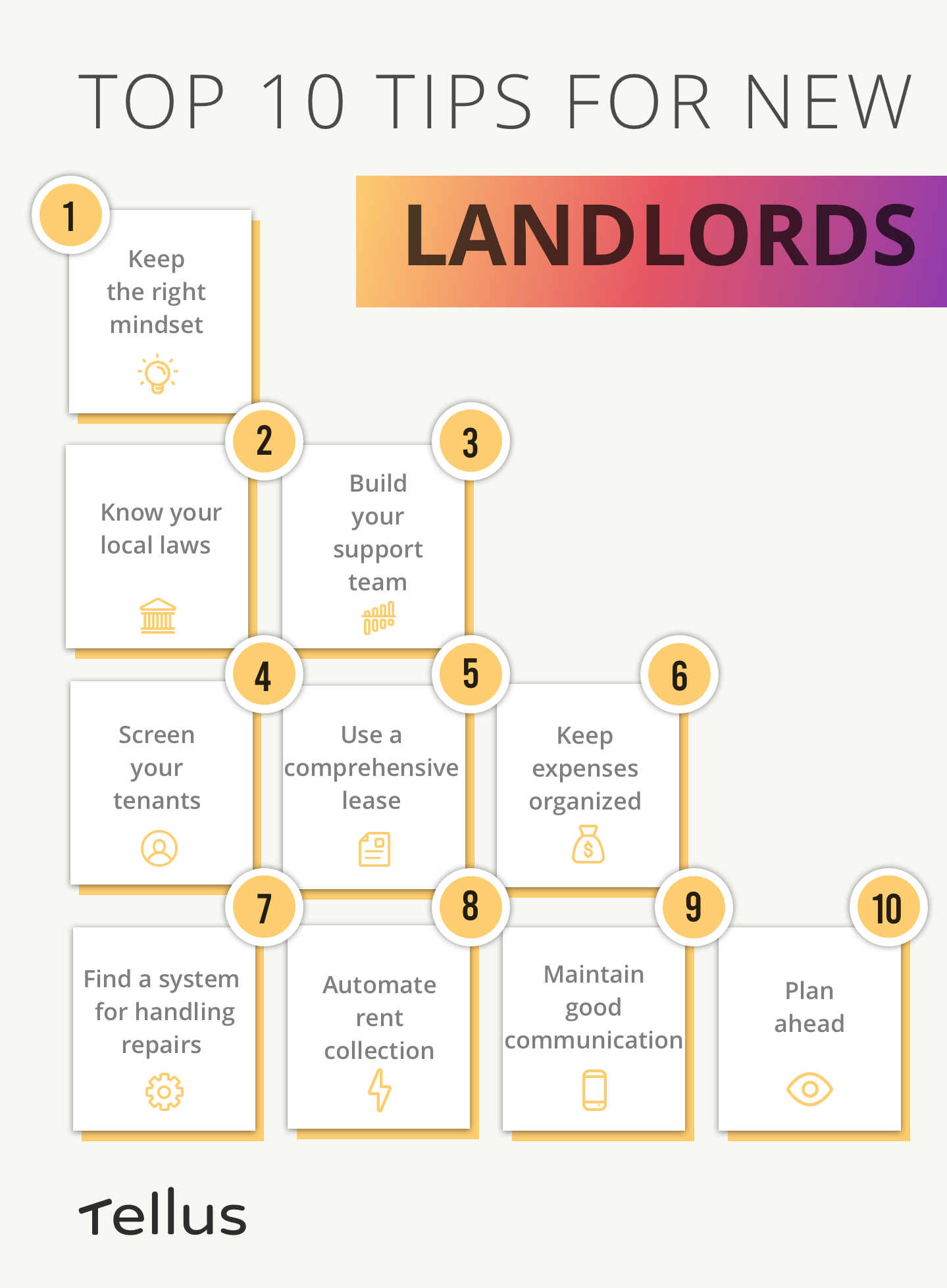

Top 10 Tips for New Landlords

If you're a new landlord, there's a lot to know about running a rental property business. Read our ten tips for success!

If you just became a landlord, you probably have a lot of questions. Maybe you got into this because you were intrigued by the idea of financial freedom. Maybe you wanted to have a nice cash flow cushion. Or maybe you’re an accidental landlord who inherited a property and don’t know where to start.

Whatever the case, we’ve got you covered. Here are some tips to get started.

Keep the Right Mindset

Remember that you’re running a business. If you treat managing rental properties like a hobby, you will lose money and get burned out.

What does treating your rentals like a business look like? It means being organized with your expenses so that you know how well your business is actually doing. It means making decisions that are in your best interest so that you’re not losing money. It also means being proactive in dealing with situations before they become problems.

Treating your rentals like a hobby means you’re just along for the ride. You miss out on financial opportunities due to a lack of planning or from being indecisive. It’s hard to scale your business with this mindset.

In contrast, your business is much more likely to grow if you plan ahead and keep your financial records organized. Even if you don’t plan on expanding, your experience as a landlord will be better if you adopt the right mindset.

Keep reading for more ideas to help you treat your rentals like a business.

Know Your Local Laws

Do you know if late fees are legal in your state? What about how much you can legally collect for a security deposit? How much notice you must give for entry? If you needed to evict a tenant, would you know where to start?

Learn More: Late Fees in California, Illinois, Texas, and Washington, D.C.

Landlord-tenant law can vary wildly by state, so it’s important to be familiar with your local laws.

Aside from being the right thing to do, knowing and following the law can help you stay above board for when things go wrong. For example, if you need to evict a tenant but didn’t follow the procedures for giving the proper notice, a judge could throw out your case.

Knowing the law will also help you feel more confident in your interactions with your tenants.

Build Your Support Team

Being a landlord isn’t something you should have to do alone. Having a team to back you up can give you enormous peace of mind. Each landlord’s team will look slightly different depending on their needs.

A broker can help you find competitive terms for a home loan.

A lender can help you finance your next real estate deal.

An agent can help you find your next property.

A property manager can help you run the day-to-day tasks, especially if you live far away.

Service professionals (handymen, plumbers, electricians, gardeners, etc.) are on the front lines if anything goes wrong.

Your real estate team should be the people you trust to help you manage and grow your business.

Screen Your Tenants

If you’re serious about running your rentals like a business, then screening prospective tenants is essential for protecting your investment.

Tenant screening will give you background information on your applicants to assess their risk to your business.

For example, a tenant with a history of late payments and a large amount of debt would be a less desirable candidate than someone with a high credit score and no late payments.

Fair Housing laws have specific requirements for considering your applicants. It’s worth your time to learn how to select your next tenant in a way that is both fair and legal.

Related: 10 Gift Ideas for Tenants

Use a Comprehensive Lease

A common mistake first time landlords make is not having a detailed, state specific lease. Having a solid lease is so much more than just the rental amount and the due date.

Think of your lease like a contingency plan. If something goes wrong (and eventually, something will go wrong), you have a roadmap for what to do next and you’re protected from liability. Did your tenant pay late? Look to your lease for late fees. Is your tenant trying to put the apartment up on Airbnb? Show them the clause that specifically prohibits subletting. What if the HOA fines you for something your tenant did? Ask your tenant to pay the fee, as outlined in your lease.

Read More: Always Include These Three Clauses in Your Lease

Keep Expenses Organized

Being a landlord comes with expenses. But did you know many of these expenses are tax deductible?

If you buy parts to make a repair, you can deduct the entire cost of the repair that year. If you make an upgrade (like a new appliance), your deduction will be scheduled over the course of several years as the value of the upgrade depreciates.

Mortgage interest, homeowners insurance, and even paying the plumber can all be deducted. If you’re a landlord, not keeping track of these expenses means you’re just giving away money.

Using an app to keep track of receipts as you get them and sort them by category can help you stay organized and not get overwhelmed as the expenses pile up.

Find a System for Handling Repairs

It’s not uncommon to hear of landlords getting burnt out trying to keep up with repairs. One way to combat this is through regular property inspections. This will allow you to spot small issues before they become major problems.

Another strategy is to automate as much of the process as possible. This way, you’re not having to scramble each time something breaks.

Instead of handling requests through phone calls or emails, an automated system lets a tenant submit a ticket when something needs repair. You receive the ticket and can schedule a handyman to come to the unit. Repairs (and any associated costs) are recorded automatically.

Automate Rent Collection

Speaking of automation, what’s better than having money show up automatically in your bank account? As a new landlord, it’s important to look for anything you can find to save you time. You don’t want to be waiting for checks in the mail when there are easier solutions available.

Some landlords choose to use apps like Venmo to collect rent, but this isn’t a platform that can scale with your business. Using Venmo and PayPal can also be dangerous, especially if you’re in a state where a tenant’s partial rent payment can halt eviction proceedings.

Keep Good Communication

Good communication with tenants can help prevent misunderstandings. The key is setting clear expectations from the start, keeping the lines of communication open, and being consistent with enforcing your own policies.

Consistency helps you to be a more professional landlord. Tenants will respect you more if they know you are the type of person who does what you say. Being inconsistent about enforcing your own lease makes a new landlord appear indecisive and leaves the tenant feeling frustrated.

As you look into ways to communicate, consider how technology can streamline the process. Keeping everything in a searchable database makes it easy to find that one message from three months ago. You may also want to look for a system that automatically backs up your communication and gives you read receipts. This way, if you ever need to prove what was said or received, you have access to records.

Plan Ahead

New landlords often find out the hard way that being a successful real estate investor takes planning, research, and organization.

Even if you have previous investing experience in areas like stocks, investing in real estate means larger sums of money and weightier decisions.

For example, as a new landlord, you’ll need to analyze the market to know how to set the right rent price. You’ll also need to research vacancy rates to see if you should consider raising the rent or keeping your price at or below market rate.

New landlords need to plan ahead for vacancies. Will you be able to cover the mortgage even when you don’t have a tenant? Is your reserve fund large enough? Are you prepared to deal with turnover and get the unit ready for the next tenant as soon as possible?

Wise landlords protect their investments. This means finding a good insurance policy, or maybe even considering an LLC.

Learn More: Should You Form an LLC for Your Rental Property?

Are you prepared for how different seasons can affect your business? For example, January is a tough month to fill a vacancy because fewer people move in the winter. However, summer might be the hard season in a college town.

There are also legal issues to consider, like rent control or city-specific ordinances for rental properties.

It’s a lot of information! But it’s important to do it right.

While it may seem overwhelming, researching different topics is a great way to start. Do research on your state laws, follow some of the links listed above, and join a real estate investing community like Bigger Pockets for advice and support.

Related: Best Practices for Landlords

Remember, you don’t have to do this alone. Consider us as part of your team! Having a free property management app like the Tellus app in your back pocket can give you enormous peace of mind. Give us a try by going to the App Store or Play Store.

Treating your rentals like a business takes some time and planning, but you will see results. This could be the first step toward something amazing.

Related: The Tellus Superapp for Rental Management: 5 Reasons Why Landlords Love It