How does Tellus transform your cash into passive income?

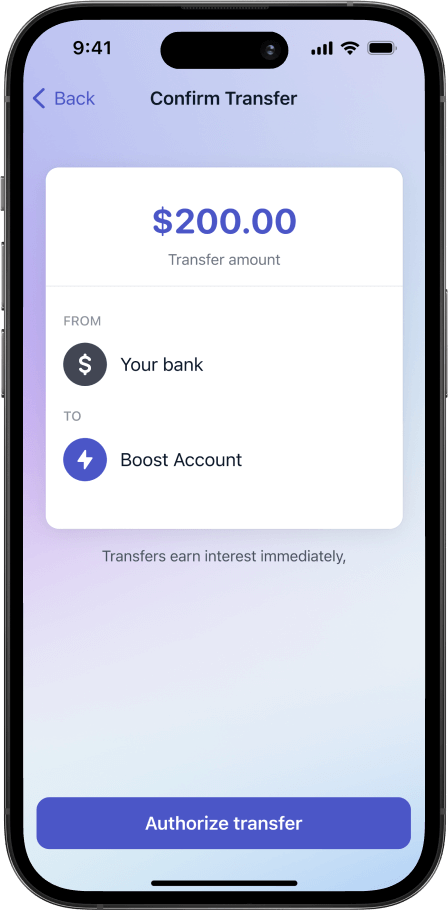

Step 1

Make a transfer

The Tellus app is mobile, seamless and 100% free. It takes 3 minutes to get set up and make your first transfer. You’ll receive your first cash rewards payout the same day.

Step 2

We’ll put your money to work.

Tellus generates income by providing wholesale business-purpose residential real estate loans to borrowers in some of the country’s most stable real estate markets. Our wholesale business-purpose residential real estate loans are always sufficiently collateralized and Tellus shares its income with you as cash rewards, so you receive daily passive income.

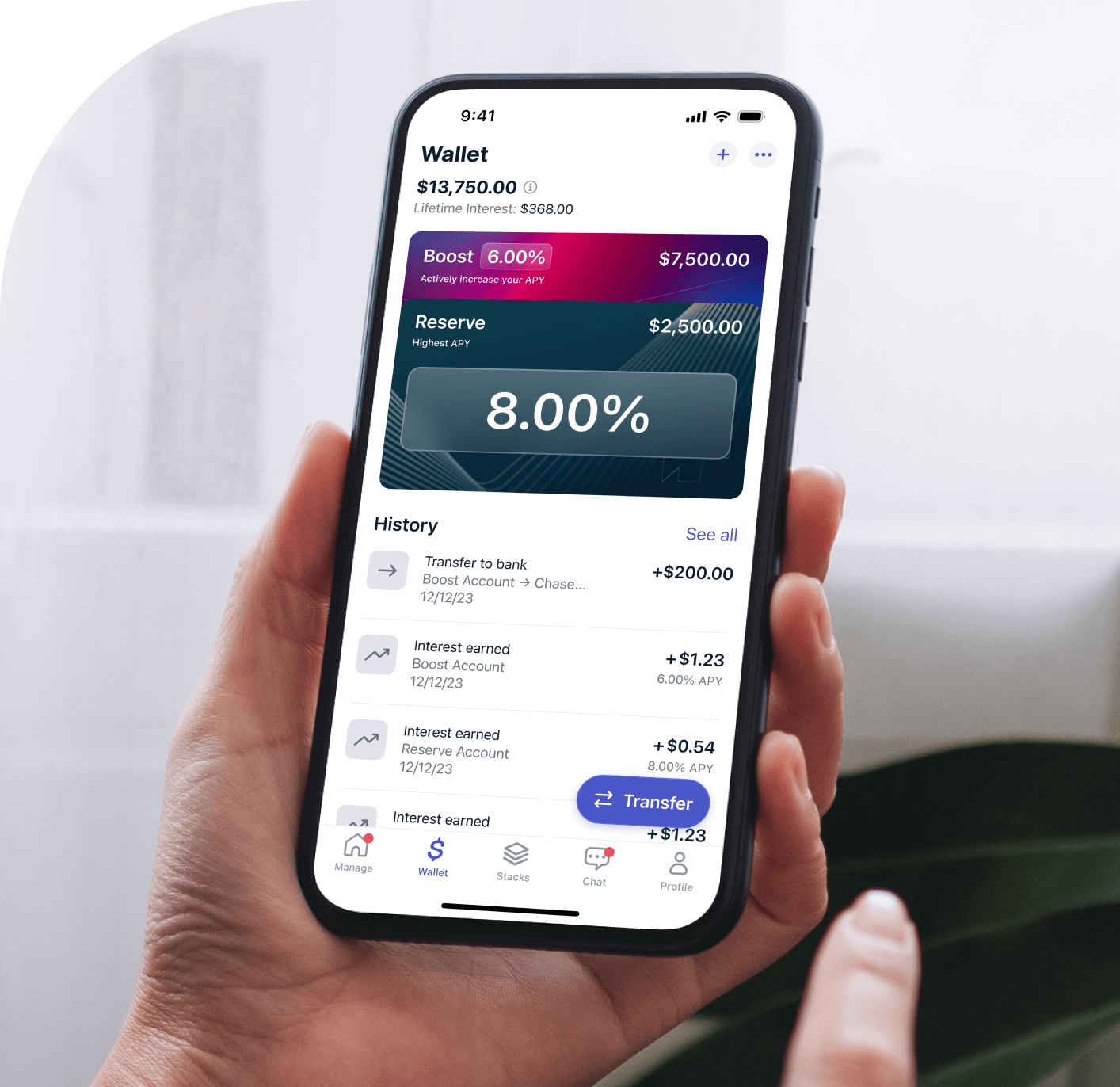

Step 3

Keep an eye on your rewards

With Tellus, you’re always in control. Our mobile app gives you a full view of your daily rewards, and your money can be pulled out whenever you need it.

Our customer service team is here to assist when you need to speak with a human.

Our customer service team is here to assist when you need to speak with a human.

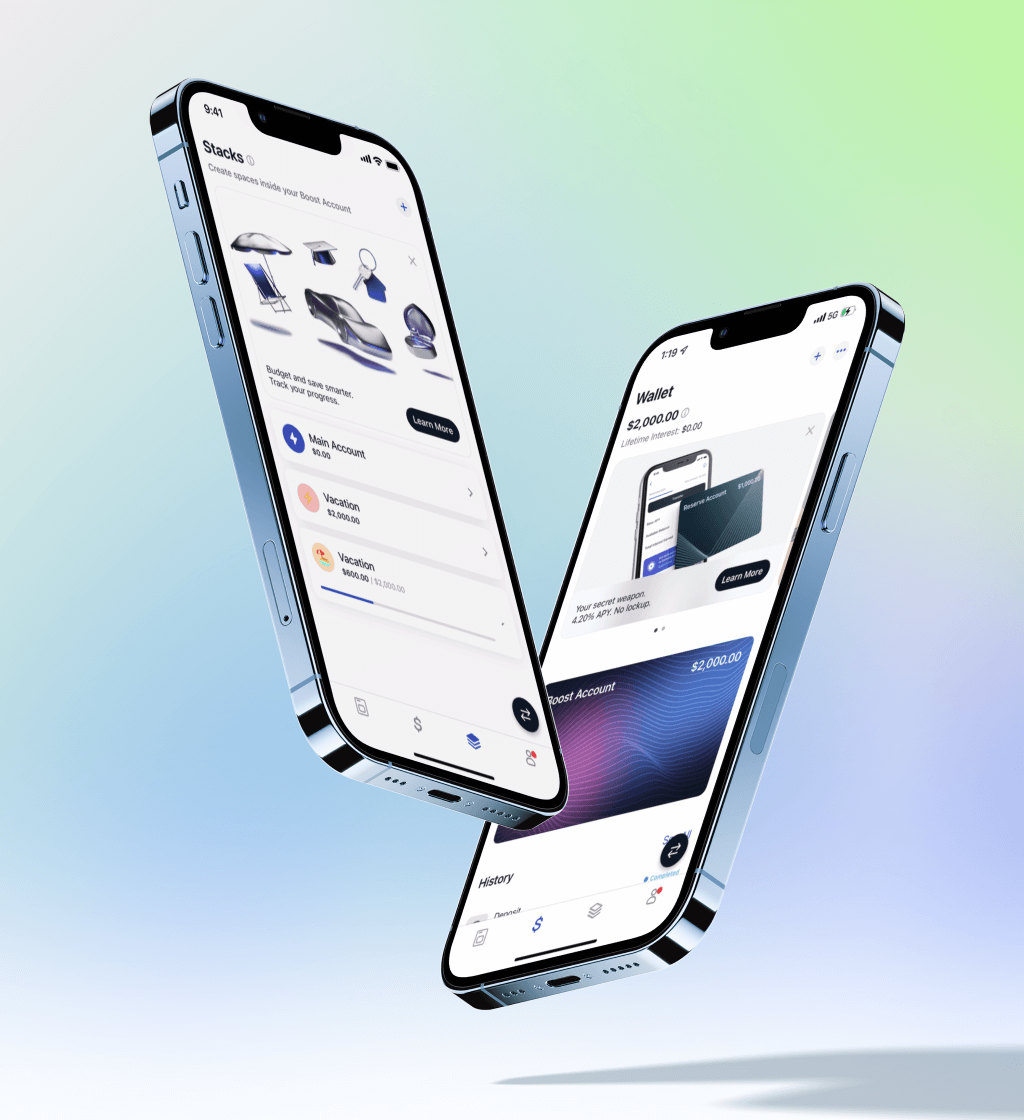

Step 4

Boost, Budget

& Automate

Tellus helps you budget your money and set goals. Organize and automate your money into buckets with Stacks. Claim free daily Boosts to increase your cash rewards.

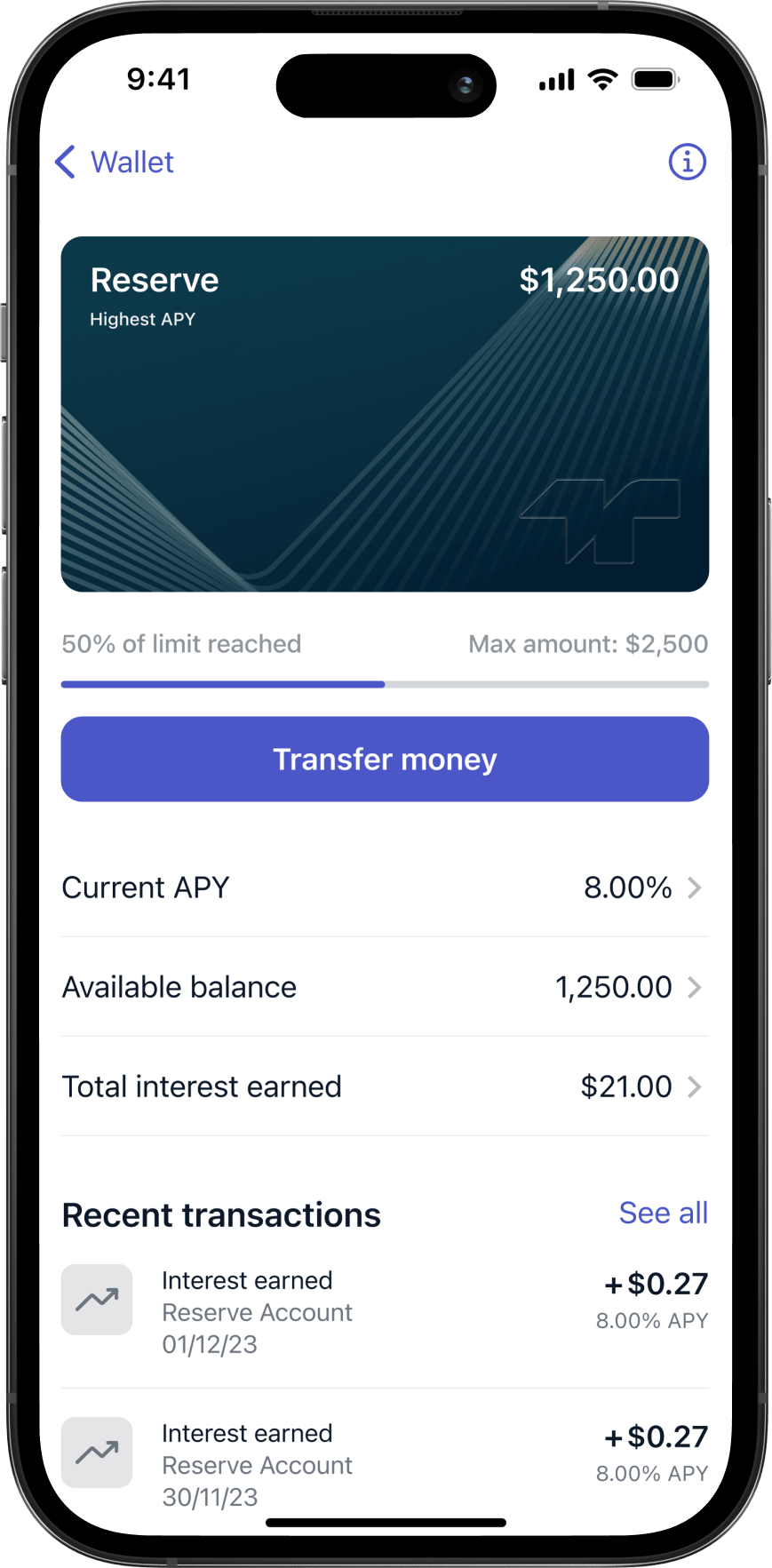

Step 5

Cash out

Your rewards are paid out daily and your money is always 100% liquid. It costs nothing to use Tellus and you can pull your money out at anytime.