Join thousands of landlords and property managers using the best tools for rentals.

World Class Property Management

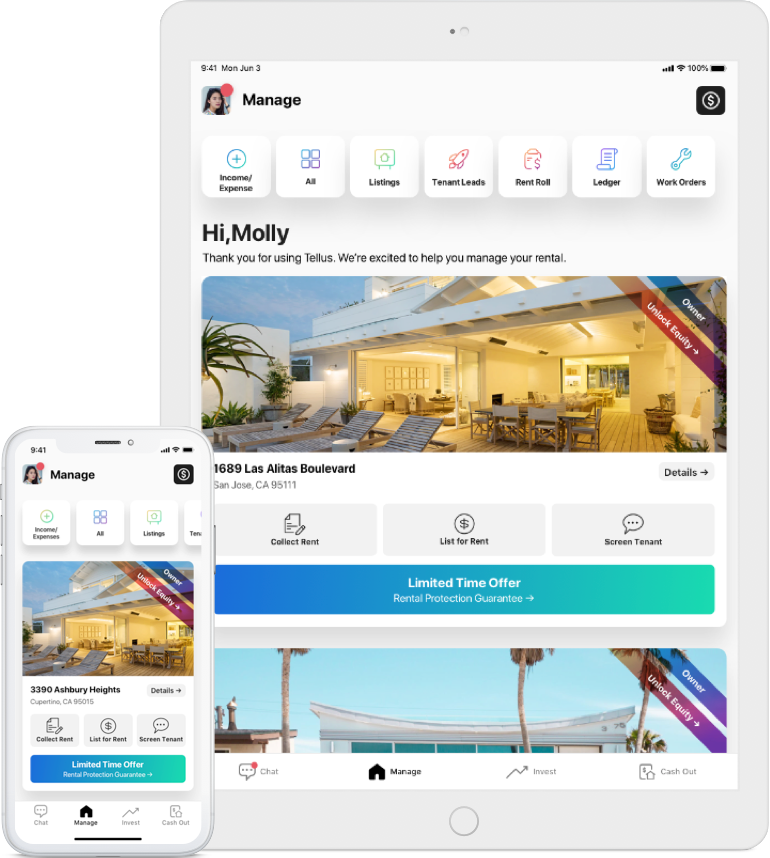

Tellus Rental Property Management

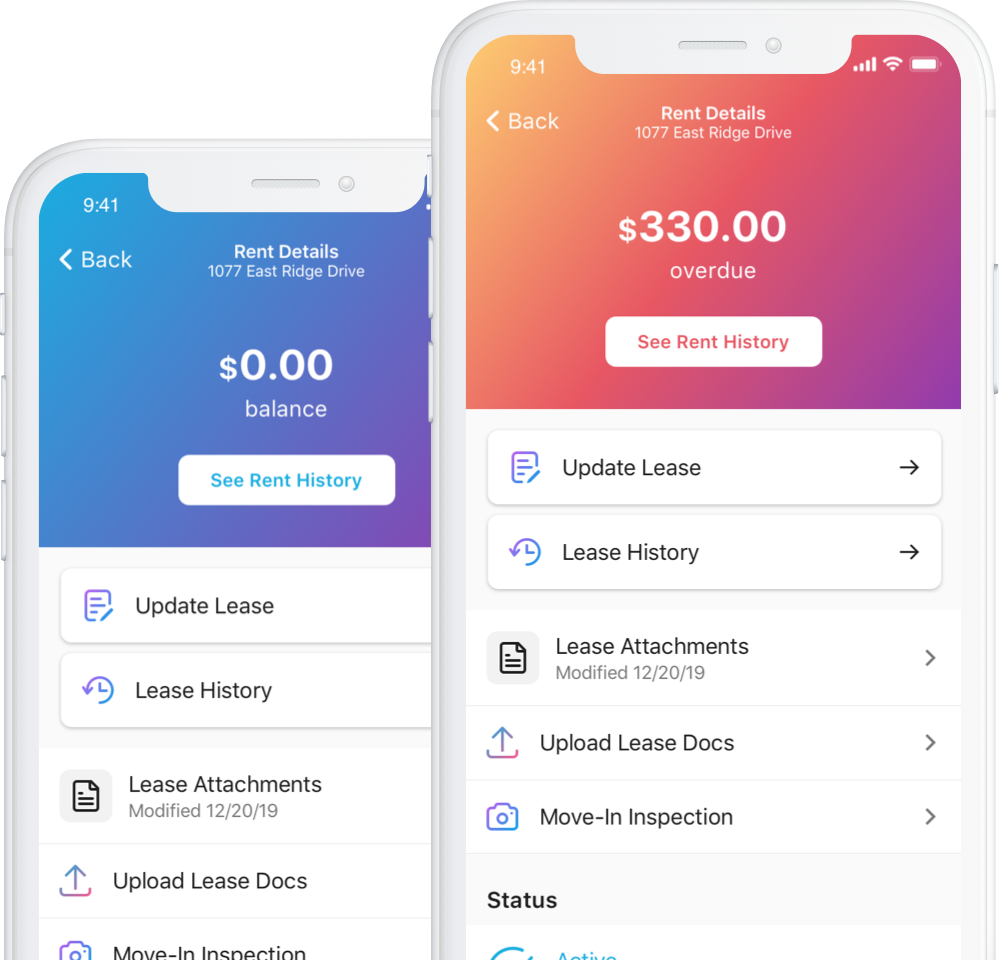

Enjoy the best rental property management tools at no cost to you. Manage your rentals with ease using our mobile property management app built for all things real estate.

Owners and Landlords

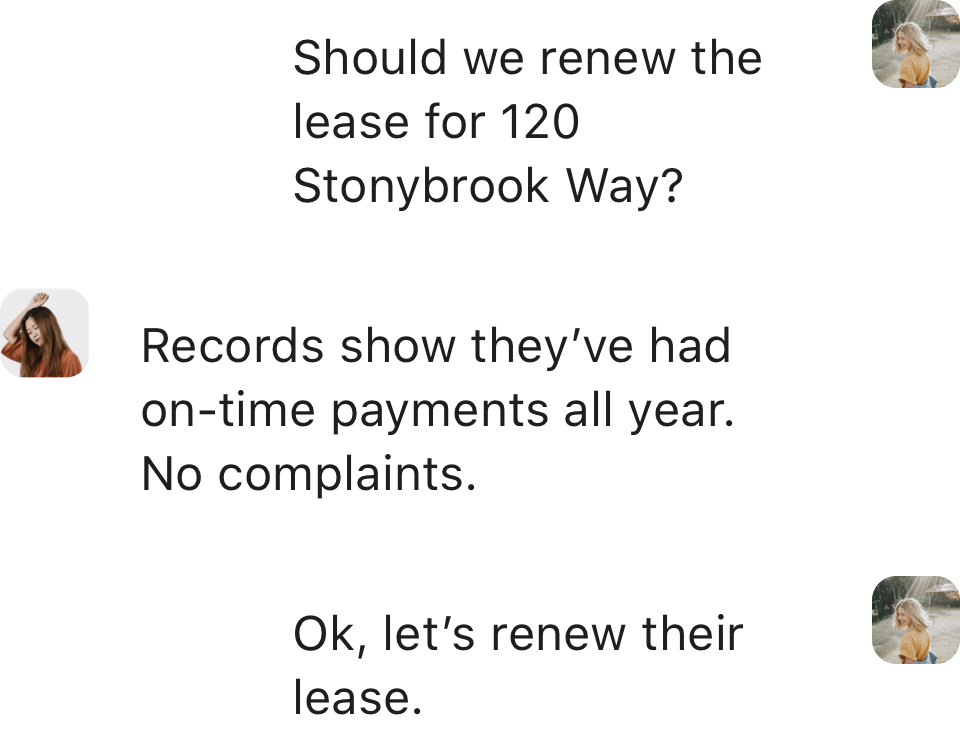

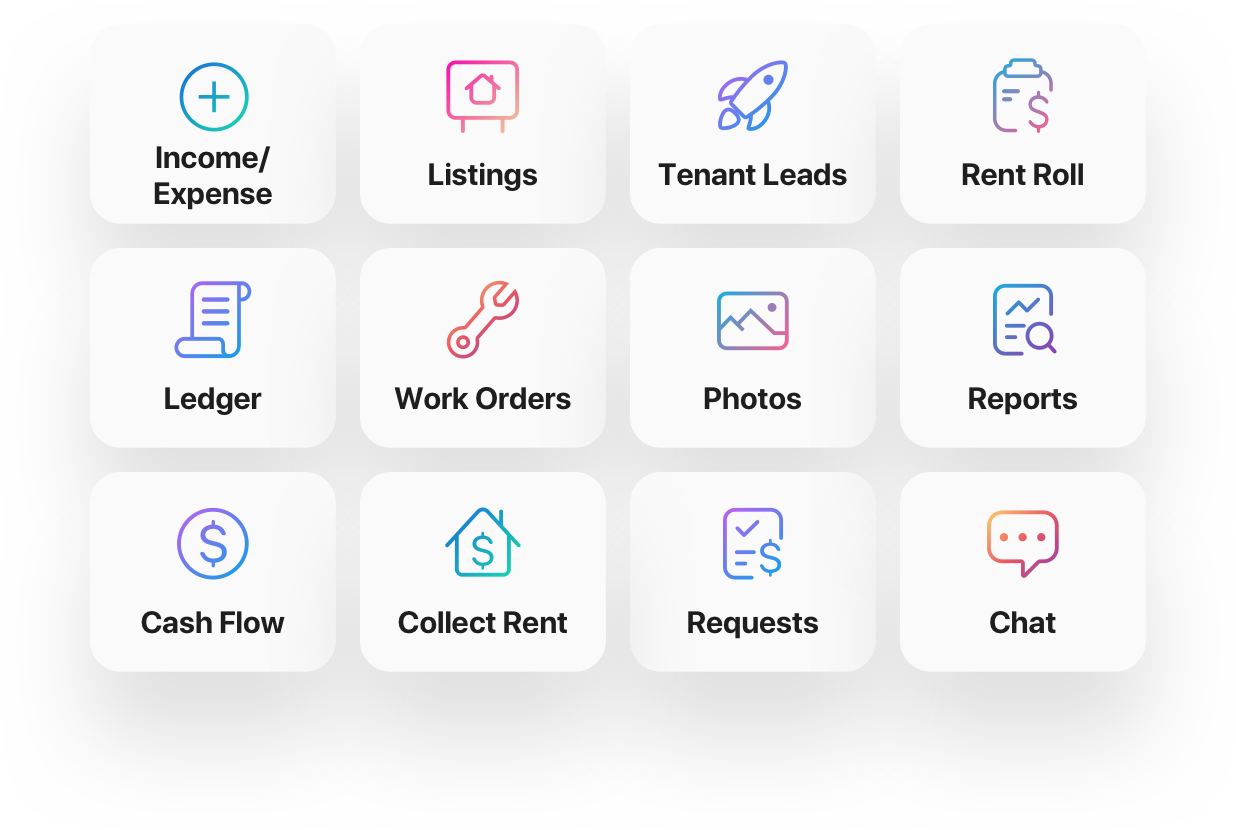

Experience the future of property management with Tellus, a one-of-a-kind property management app designed for all parts of your rental property business. Get the most out of your rental property with loan offers, rental insights, and automated workflows. It’s property management, simplified.

Property Managers

Stay on top of things with detailed organization and easy communication with every tenant or service provider. Keep everyone in the loop and impress your clients. This rental property management app makes it easy for you to be the best in the real estate rental business.

Renters

Enjoy stress-free renting with one-tap payments, AutoPay, rent reminders, rental chat, and quick responses to repair requests. Renting your home has never been easier!

Complete Rental Toolkit

App Built for Landlords, Renters,

and Property Managers