Should You Pay Off Debt or Save?

Is it better to pay off your debt or save first? Learn which option is right for your personal life situation.

It can be hard to decide if it’s best to pay off debt or save first in your specific situation. It usually makes sense to start an emergency fund first if you don’t already have one. Keep reading to learn different strategies for paying off debt.

You have a limited amount of money. It can be difficult to figure out the best way to use it. Should you pay off debt or save first?

On the one hand, it’d be nice to relieve yourself of the burden and stress of being in debt as quickly as possible.

On the other hand, you need to start saving for a down payment if you ever hope to own a home. And if you don’t start saving for retirement now, it could make things difficult down the road.

Thankfully, there are established strategies to evaluate your finances and decide which option is best for you. Or perhaps the answer is somewhere between the two.

In this article, you’ll learn if it’s better to pay off debt or save. And we’ll explore a middle-ground where you’ll hopefully be able to accomplish both goals at the same time.

Contents

Is it better to pay off debt or save?

Personal finance is a complicated topic, and it’s highly personal. So the honest answer to whether it’s better to pay off debt or save is: It depends.

What’s right for your specific situation might not be right for someone else. It all depends on what types of debt you have and how much, the interest rates that you’re paying, and other factors.

For example, if you have a credit card with an interest rate of 20%, then it’ll usually be best to prioritize paying that off. But if you have a card with an introductory offer that includes low or no interest, then it could be better to save.

If you’re carrying a form of toxic debt, such as a payday loan, your priority should be to pay it off as soon as possible. These types of loans typically have interest rates of 400% APR or more!

Other forms of debt, like a mortgage, are a lower priority for paying off. The interest rate on a mortgage is typically lower, and you have a physical asset backing the loan that is hopefully accumulating value over time.

No matter what type of debt you’re carrying, it’s always best to make at least your minimum payments to avoid taking a hit to your credit score.

Start an emergency fund first

Carrying debt can be stressful. It’s a common experience for many people, and you’re not alone.

Every month that you carry a balance on your credit card or another form of high-interest debt, you’re paying a lot for it. So it can be tempting to put as much money as possible toward paying it off.

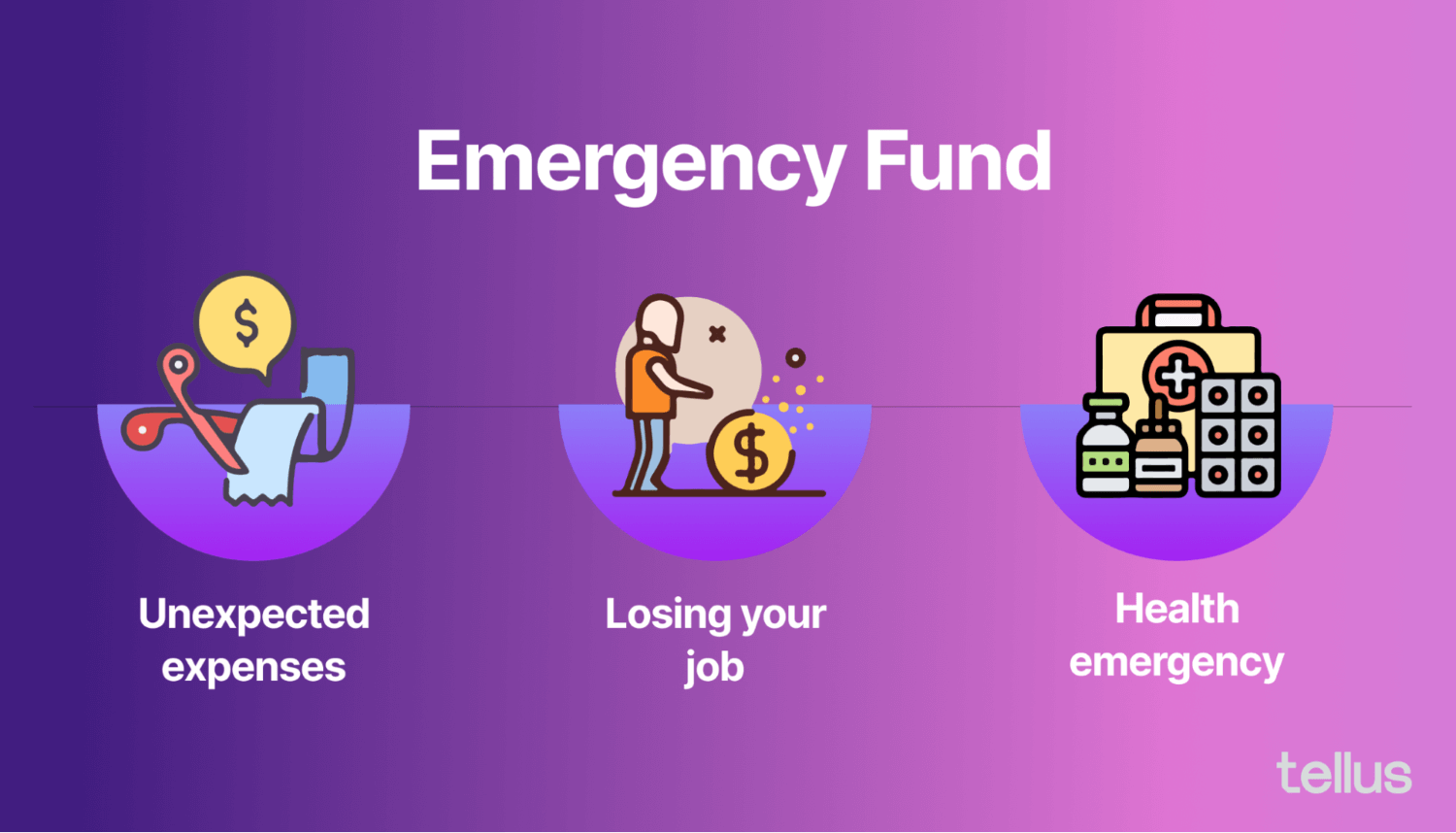

But first, you’ll want to establish an emergency savings fund before putting all your money into paying off debt.

You don’t want an unexpected expense like a furnace breaking down or losing your job to throw your finances even more off track.

56% of Americans can’t cover a $1,000 emergency expense with their savings. If you fall into this category, then it’s time for you to start your emergency fund.

Before you can start on your path to becoming debt-free, you want to have the peace of mind that you can still cover your bills for a few months if something goes wrong.

Strategies for paying off debt

Paying off debt will reduce the total amount of interest that you pay every month.

It can also help your credit score, provide peace of mind, and lift the emotional burden caused by being in debt.

The average student borrower will take 20 years to pay off their student loan debt, so it’s important to have a good sustainable strategy in place. That way, you can consistently pay off your debt over time.

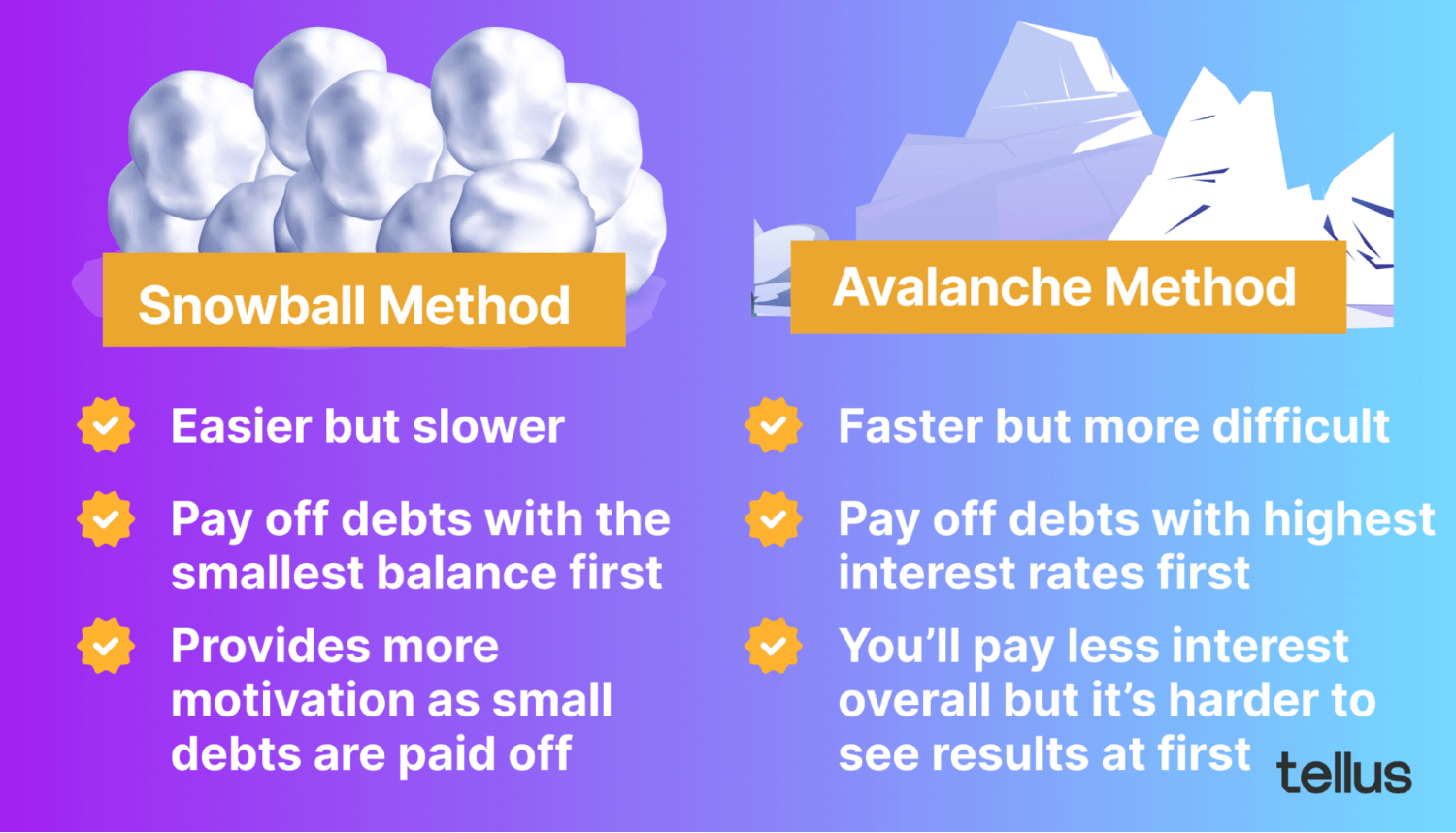

Let’s talk about two of the most common strategies for paying off debt. These are referred to as the avalanche and snowball methods.

Avalanche method

The avalanche method is a highly strategic approach to paying down debt.

In this model, you put all of your extra money toward paying off your debt where you’re being charged the highest amount of interest first.

There isn’t much benefit to paying more than your monthly minimum on your mortgage if you have higher-interest debts to pay off first.

You’d start by paying off your credit card debt with a 20% interest rate. Then move on to the next-highest interest rate, such as a mortgage with a 5% interest rate. You would only start putting extra money toward an auto loan with a rate of 3% once your mortgage is paid off.

However, there are other strategies to consider within the avalanche method, too.

If you can, look for ways to delay some forms of debt so that you can prioritize others. For example, you might be able to get a deferment or even loan forgiveness on your student loans.

You can also look for ways to refinance or consolidate high-interest debt into lower-interest debt. For example, you could pay off your credit card debt with a 22% interest rate using a line of credit with a 5% interest rate.

That way, you’re effectively reducing the amount of interest you’ll need to pay by 17%! On larger debt balances, this can easily save you thousands of dollars.

Another good way to reduce the amount of interest paid actually involves opening a new credit card. This can sound counter-intuitive, but many cards will offer you an introductory 0% rate for the first year and allow you to do a balance transfer to move your debt from an existing credit card to a new one.

Just don’t make the mistake of racking up a balance on your original credit card once you’ve wiped the slate clean. Try to take advantage of the 0% interest and pay off your debt before you start getting charged a higher rate again.

Snowball method

With the snowball method, your focus is on paying off your smallest debts first, then working your way up to the larger ones.

This method isn’t as optimal as the avalanche method, and you won’t save yourself from paying the most amount of interest.

However, it provides a psychological benefit to many people. It can be encouraging to see your smaller debts being completely paid off rather than putting money toward a larger debt where you seem to be barely making a dent.

Make a budget

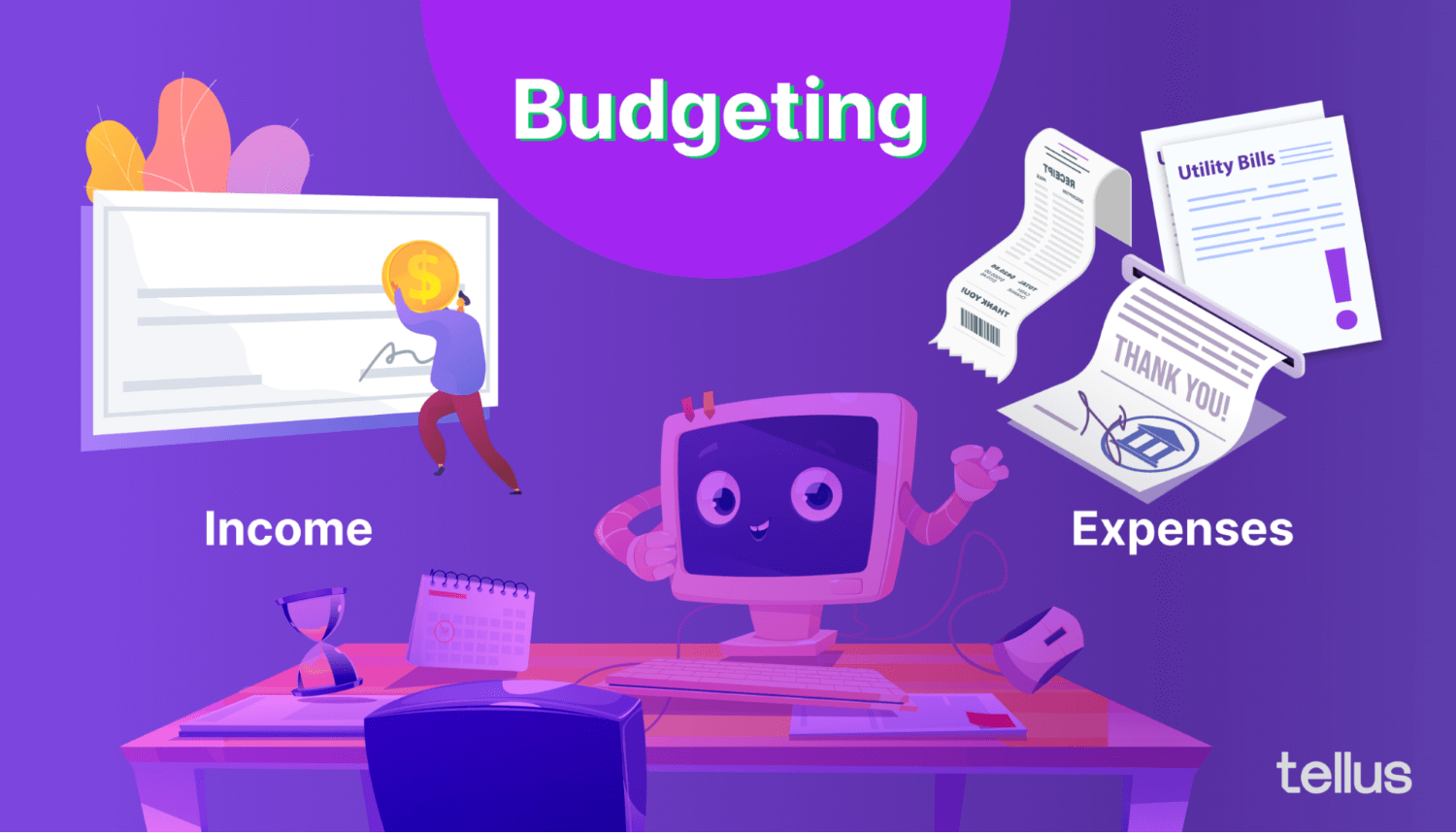

Before you can start using either the avalanche or snowball method, you’ll need to make a budget for yourself.

A budget gives you a good idea of your overall financial situation. Without a budget, it’s hard to tell exactly how much money is going in and out of your bank account each month. And you can’t assess areas where you can potentially cut down on spending.

Once you have a budget, you’ll know how much money is left over every month or pay period to either pay down debt or save.

You can also start looking for areas in your budget where you can reduce your monthly expenses. For example, you could eat at restaurants less frequently or cancel a streaming service you hardly use.

Track your spending and cut out anything inessential if you want to pay off your debt and start saving more quickly.

While it can be a difficult lifestyle adjustment at first to cut out that Starbucks coffee every morning or brunch every weekend, your bank account will thank you in the end.

When thinking about your budget and creating a financial strategy, try to think long-term. Would you rather be in debt and working forever? Or are you willing to give up some comforts today in exchange for a debt-free retirement where you don’t need to worry about finances?

Strategies for saving

The sooner you can start contributing to your savings, the more years your money will have to benefit from the effects of compound interest.

So while it can be tempting to put off saving until later in life, you’ll put yourself in a much better position by starting today.

Without savings, you’re more likely to turn to credit cards again in the future to cover unexpected expenses, which will only increase your debt and start the whole cycle over.

Here are some strategies for saving you can start using today.

Take advantage of windfalls

Whenever you receive unexpected money, like a bonus at work or an inheritance, put it toward your debt payments.

It can be tempting to use this money to buy a new vehicle or splurge on a new wardrobe. But an unexpected $1,000 will go a significant way to building up your savings.

Don’t contribute more than you can afford

When people realize the importance of saving, they sometimes get overzealous and start saving too much.

Make sure not to contribute money that you might need in the future to something like a 401(k). If you withdraw from these types of accounts early, you’ll get charged income tax plus a penalty.

You want to keep a good portion of your savings in a savings account or some other type of investment that you can quickly access if you unexpectedly need the cash.

Maximize matching from your employer

If your employer matches contributions to a retirement plan, take advantage of it if you can afford it.

For example, your employer may match 50 cents on every dollar that you contribute up to 5% of your total salary every year.

So if you earn $60,000 per year and contribute $3,000 to your retirement account, your employer will add in an extra $1,500. It’s basically free money.

If it’s within your budget, try to contribute enough to take advantage of your employer’s full matching amount each year.

Start small

Even if you’re just working a part-time retail job, it’s important for your future to start saving something.

Even setting aside $20 every week is better than not saving at all.

Utilize a high-yield savings product for short-term savings

High-yield savings products can help you grow your savings faster than traditional savings accounts. You can generally find high-yield savings products at online banks, credit unions, and fintechs. These institutions or companies normally don’t carry the overhead costs or profit-margin requirements of a traditional brick-and-mortar bank, allowing them to pass those savings on to customers through higher rates and lower fees. Interest rates vary based on several factors, but it’s not uncommon to find high-yield savings products that offer up to 2.00% APY or more.

Take advantage of automatic transfers

Pay yourself first.

You can get your employer or bank to set up automatic transfers, so a portion of your money each month will go straight into a separate savings account.

That way, you don’t need to think about it and manually go into your online banking each month to move money around. There’s also less opportunity to justify to yourself why you should spend that money instead of saving.

Once you start taking advantage of automatic transfers, you won’t even notice the money missing from your paycheck after a while.

Have clear financial goals

It’s easier to start saving money if you have a goal and a strong reason in mind for why you’re doing it.

For example, saving to buy a house or a car.

You can imagine what it’ll actually be like to own your own home or drive that new car in the future.

It makes saving a lot less abstract than just setting aside a certain number of dollars every month.

So is it better to save or pay off debt? Why not both?

Paying off your debt completely and staying debt-free might not be a viable option for you.

You’ll want to pay for other things in life, like buying a house or paying for college, that will likely require taking on more debt.

You have to find the right balance that will work for you. Create a budget, figure out what’s reasonable, and then stick to your plan.

For most people, it’s likely best to put most of their extra income toward paying down debt while creating an emergency fund and continuing to make smaller regular contributions toward their savings.

Then, when your debt is paid off, you can start contributing larger amounts to your savings. You’ll have all of the extra money that you were previously putting toward your debt every month.

Paying off debt vs. saving — It’s a fine balance

It’s important to find the right balance of saving and paying off debt for your personal situation.

First, make sure that you can make all of your minimum monthly payments each month. Then, save up an emergency fund that’s large enough to cover all of your expenses each month.

Once that’s done, you can start thinking about whether the avalanche or snowball method for paying off debt makes the most sense for you.

And if you’ve still got money left over, consider turning it into passive income by downloading the Tellus app.