How to Save for a House: The Ultimate guide

Want to start saving for a house? Check out this helpful guide.

Getting on the housing ladder is a huge life achievement — it’s such a huge achievement because it can go hand-in-hand with a pretty big price tag.

You don’t need to be a real estate agent to know that buying a house isn’t cheap. There are loads of different costs you have to bear in mind, some market nuances to be aware of, and different loan products on the market that are going to dictate how much you need to save and what kind of interest rate you’re going to be paying for the next couple of decades.

But don’t panic because we’re here to help.

This guide will explain how much you need to save for a house, how much you should aim to put down, how your credit score affects your mortgage rate, and the methods you can use to save for a house (including a high-yield savings or high-yield cash account).

How much do you need to save for a house?

The answer to this question depends greatly on your circumstances, what you’re buying, and where you’re buying. But generally speaking, if you’re getting a mortgage to buy a house, a lot of financial experts say you should save up at least 25% of its sale price in cash.

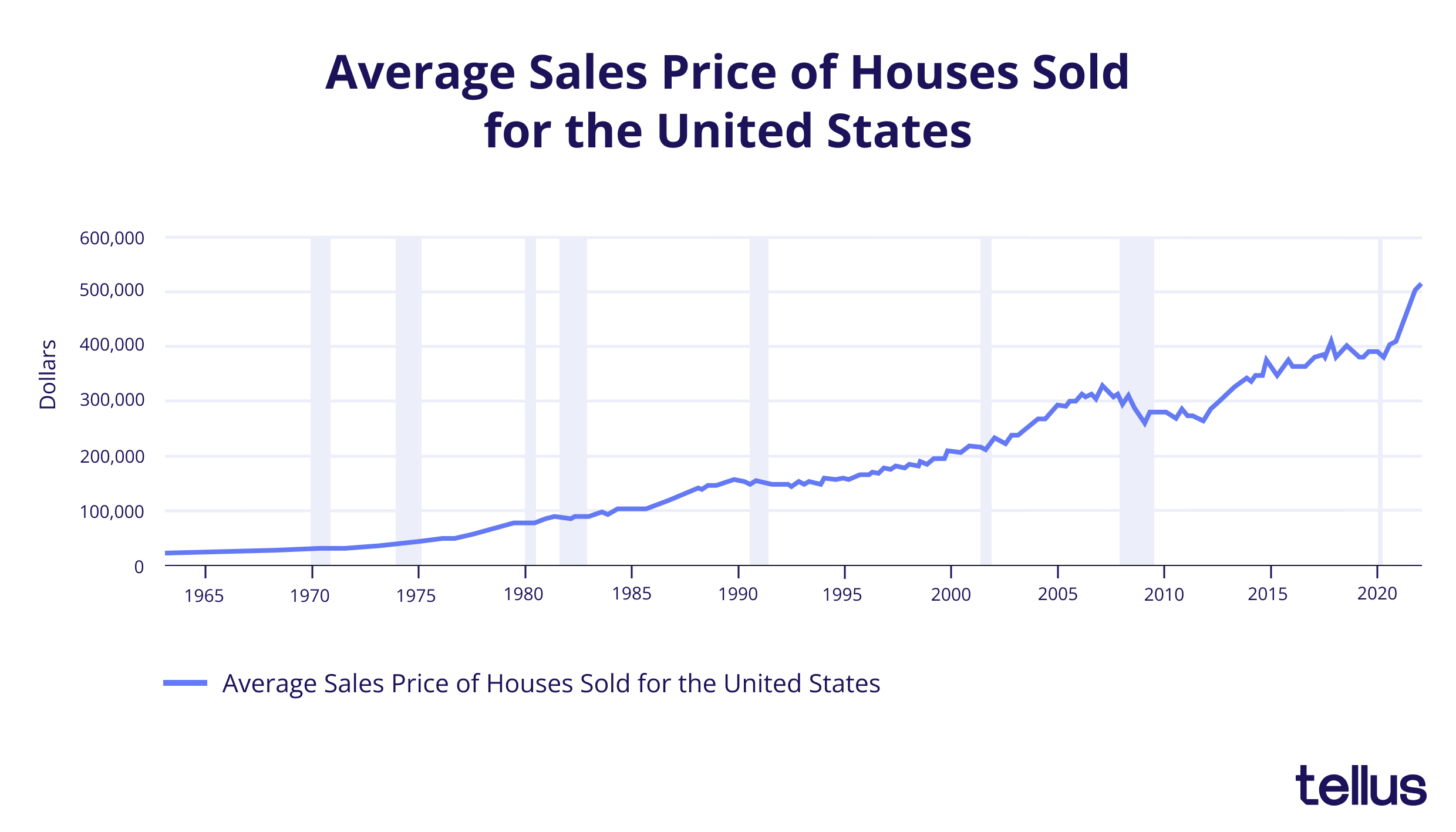

If you’re wondering what that means in terms of hard numbers, we can dig into some stats.

At the start of 2022, the average price of a home in the US was sitting at $507,800. If we’re going by the 25% rule, you’d need to save up to $126,950 in cash.

But again, this is just a rule of thumb. The cost of your dream home will vary a lot based on location and property type, and the amount you have to save will depend on a few different factors, too (more on that in just a minute).

First, let’s talk about where and how that 25% in cash is going to get spent.

What expenses do you need to save for when buying a house?

When you’re saving for your first house and haven’t yet hopped onto the property ladder, there are a couple of key expenses you’ll need to save for that you might not have considered.

First, there’s your down payment.

This is the biggest expense when you’re buying a house. A home down payment is just the part of your new home’s purchase price that you’re choosing to pay upfront. You’ve got to pay this lump sum to your mortgage lender, who’ll then provide the additional funds needed to reach the property’s agreed price.

After this has been paid, you’ll be expected to repay your mortgage in incremental (normally monthly) amounts, including interest.

How much money will you need for a downpayment?

Again, it depends. But let’s say you want to buy a house that’s priced at $250,000. If you were to submit a down payment of $50,000 toward the purchase price (or 20% down), that’d mean you'd be taking out a mortgage for the remaining $200,000.

Generally speaking, 20% has long been the industry standard for a downpayment — but this is starting to change (we’ll get into that in just a minute).

So, if experts are saying you should save up to 25% of your total house price, where’s that other 5% worth of expenses coming from?

First, there are your closing costs. Closing costs are all the taxes, administrative fees, and commissions you’ll need to pay when you sign your mortgage document.

In 2021, the average closing costs for a family home in the US were sitting at $6,837, including taxes. But even when you strip out property taxes and transaction taxes, you’re looking at an average cost of $3,836.

Finally, there are your moving expenses.

Let’s face it: buying a house can be stressful. That’s why many prospective homeowners get so busy budgeting for their down payment and closing costs that they forget to set cash aside for moving day.

Between hiring a moving truck, getting things installed in your new home, and packing supplies, these moving costs start to add up quickly.

Right now, the cost of moving can range from $270 to $2,200. But if you’re looking for a nice, middle-of-the-road number, the average cost of moving expenses is around $1,000.

How much should you put down when buying a house?

We know you’re going to get sick of hearing this answer, but again, the truth is: it depends.

Before we get into numbers, it’s worth looking at how banks decide what your down payment should be in the first place.

How do banks decide how much money you can borrow?

After you’ve been pre-approved for a mortgage, your mortgage lender will tell you the maximum loan amount you qualify for. This information is going to be based on the information you included in your mortgage application — which will typically ask for, among other things, the estimated amount of money you’re prepared to put down.

The amount of money your lender is willing to loan you will also depend on other things like your annual income, employment record, current debts, and assets. Likewise, most mortgage lenders will also pull your credit report so that they can analyze your credit score.

Together with the factors we’ve already mentioned, your credit history and income levels are ultimately going to influence your lender’s decision about whether they want to lend you money, how much they’re willing to loan you, and what the terms and conditions of that mortgage agreement are likely to be.

As a general rule of thumb, a lot of banks advise prospective homeowners to consider properties that cost between two and two-and-a-half times their gross income. For example, if you earn $100,000 a year and your spouse is making $50,000 per year, you’ll likely be approved for a mortgage on a house costing between $300,000 and $375,000.

Deciding how much money to put down

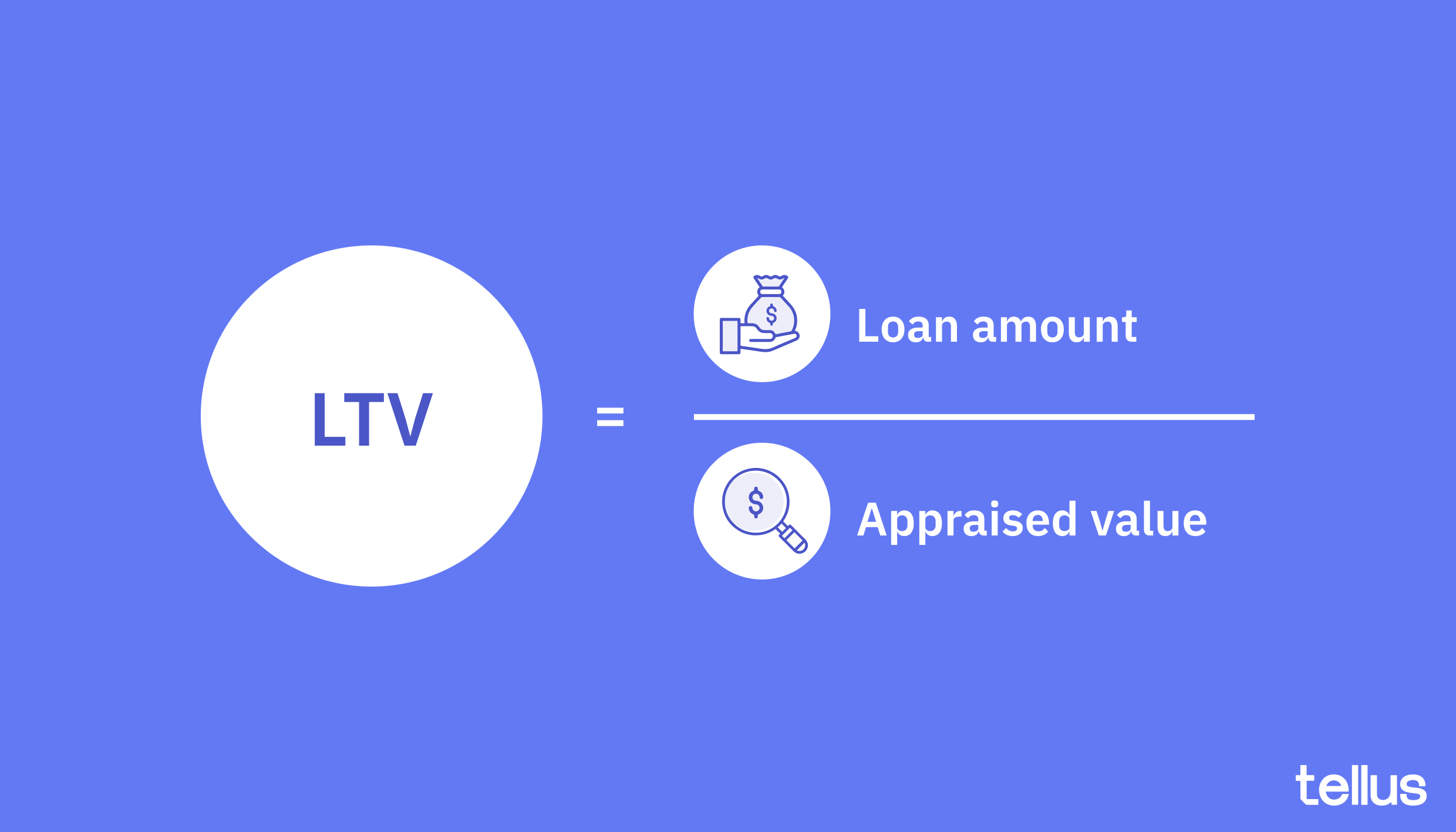

Your down payment is going to play a huge role in the amount of money a bank is willing to lend you — and that’s because of something called your loan-to-value ratio (or “LTV ratio”).

Your LTV ratio is an algorithm banks use to decide how risky it’s going to be for them to offer you a loan. To calculate your LTV ratio, banks divide the loan amount by your new property’s fair market value. The property’s market value comes from a property appraisal (or “inspection”).

If your LTV ratio is high, that means your bank considers the mortgage a riskier investment for them.

In fact, if your LTV ratio is higher than 80%, your lender will normally require you to take out private mortgage insurance (PMI) as a condition of your mortgage. Rather than an upfront payment, this is generally just tacked onto the monthly mortgage payment you’ll start repaying after the paperwork is signed.

Where does a down payment come into all this? Simply put: the bigger your down payment is, the lower your LTV ratio is going to be. That means you’re borrowing less, which makes lending you money less risky for banks.

As a result, not only will a higher down payment help you avoid having to get PMI — but it’ll also often earn you a cheaper interest rate and shorter repayment terms.

A larger down payment will also normally make you look a lot more competitive as a buyer. That’s because you’ll be seen as more reliable and less likely to haggle with low offers or ask your seller to pay part (or all) of the closing costs.

So, that’s why you’ve got to think hard about how much money you need to put down. But what’s the golden amount you should be saving for?

Your target down payment will depend a lot on the loan product you’re looking at — never mind your total purchase price.

For example, with a conventional loan, you’ll normally be expected to pay between 10% and 20% of the total house price as a down payment. That means if you’ve got your eye on a house that costs $200,000, you should be prepared to save between $20,000 and $40,000 for your down payment.

That being said, you can find some individual lender programs that’ll only require you to pay between 1% and 3% down. But you’ll really have to shop around for this sort of deal, and a lower down payment will normally lead to higher interest rates and a longer repayment schedule.

If you’re a US military service personnel or a registered veteran, you might be able to qualify for a zero-down loan backed by the US Department of Veteran Affairs — which would mean you don’t have to pay anything toward your down payment.

You’ve also got a range of special programs in various states that are sponsored by local housing authorities as a way to help first-time buyers get on the property ladder. A lot of these programs are based on your income or financial need and can sometimes offer you a grant toward establishing a down payment.

Does your credit score affect how much you need to save for a house?

Yes: your credit score can definitely affect how much you need to save for a house.

As we’ve already mentioned, banks look at your credit history as part of the lending process — and although you don't necessarily need a flawless credit score to get a mortgage with a low down payment, it’s going to help.

If you’re in the market for a conventional mortgage loan (like most people are), you’re going to need a good credit score if you want to put less than 20% down. You'll typically need a FICO Score of at least 620 to qualify for a conventional loan — and if your score is better, your lender will generally let you pay less money down.

But if your credit score isn’t great, don’t despair. You’ll still have some options. For example, you may qualify for a Federal Housing Administration (FHA) loan. FHA loans have pretty lenient credit score requirements and require no or low down payments.

That being said, it doesn’t really matter what type of mortgage you’re aiming for. Either way, you should be doing your best before applying for a mortgage to ensure your credit score is mortgage-ready. That means working to reduce your debt and making sure you pay all of your bills on time.

You should also try to avoid making new applications for credit unless it’s totally necessary. This is because loan applications can lower your credit score slightly and will pop up on the credit reports that your mortgage lenders pull.

You should also ensure you’re keeping a close eye on your credit report before applying for a mortgage to make sure there’s nothing in there that’s going to impact your chances of getting approved. If a late payment or some other black mark pops up, you may want to wait a while to get your mortgage and put in some more work repairing that blip to maximize your chances of approval.

How do I start saving for a new house?

We’ve talked about the expenses you have to be saving for and the factors you’ll need to consider in terms of your savings goals.

But how exactly are you supposed to start saving for a new house?

Although no two spenders are totally alike, there are a few tried-and-tested saving strategies that are definitely worth exploring. To help you get started, let’s take a look at a few of the most popular savings options.

Pay off high-interest debts

Before you start saving for a down payment on a new home, your first step should be to get rid of any high-interest credit cards or other outstanding loans.

That’s because banks will look at these debts and think that they’re going to affect your ability to take on a big new debt in the form of your mortgage. High-interest debts also hurt your credit score, which is another factor banks look at which will determine how much cash you have to put down.

To save money in the long term, you should focus on paying down these accounts before you start working on saving for a mortgage. This will create a positive snowball effect on slashing your debts and improving your credit score. After these accounts have been paid off, your spending power will then be able to go toward making a monthly mortgage payment instead.

That being said, it’s important that you don’t close these accounts even after paying them off.

Closing a credit account can often lower your credit score because you’re effectively cutting ties with an open line of credit. This hurts your credit history — so instead of closing the accounts, just try to use them sparingly. When you do use them, make sure you pay the balances as quickly as possible.

This sort of positive credit behavior can boost your credit history and help your score creep up a little bit.

Cut back on your spending

This one is pretty obvious, but we can’t emphasize it enough.

If you’re saving for a new house, you’re probably going to be careful about making big purchases that’ll put a dent in your down payment fund. That means axing the expensive vacations, new cars, and flashy jewelry. But what you might not be keeping as close an eye on is all of your little outgoing expenses.

Fast food on a Tuesday night, drinks with friends, subscriptions to streaming services that you don’t even watch — all of these things add up fast. If you really sit down to assess all of your outgoing expenses and are able to slash the spending you don’t need to be making, you’ll be shocked at how much extra money you’ll have to pay down other debts or deposit into your savings account.

Just look at it this way: by making a few small sacrifices now, you’ll be able to achieve your homeownership goals a little bit faster.

Create an automated savings plan

You may already have a regular savings account or an emergency fund account. But if you haven’t already, it’s worth setting up a dedicated savings account specifically for your down payment.

You can then set up an automated deposit so that every time you get paid, a small proportion of that gets placed into your deposit fund without you having to lift a finger. This takes the pressure off of you to remember to deposit money each month, and it’s a great way to make sure your balance continues to grow over time.

With Stacks — simple, customizable sub-accounts — you can categorize and visualize your money, and track your progress toward your financial goals, like saving for a house. You can even add recurring transfers to your Stacks. Start a Stack for your dream home today. 🏠

Invest

If you have a bigger appetite for risk, you might want to consider using an investment account to grow your house down payment.

By setting up an investment account with a brokerage firm, you can invest your savings in securities like stocks, bonds, exchange-traded funds (ETFs), and mutual funds that may increase in value and generate passive income in the form of dividends and compound interest.

This is a great way to generate a big nest egg because stock markets have the power to make your cash pile grow exponentially. But it’s also important to remember that the stock market isn’t a sure thing. Markets can get volatile, and there’s no guarantee you’re going to make money in securities.

That means you have to tread carefully (and don’t put all your eggs in one basket).

Conclusion

At the end of the day, it’s important to have realistic expectations about how much you should be saving to buy a house — and the expenses you’ll need to cover.

Your down payment is the single greatest expense you’ll need to save for as part of buying your new house, so it’s critical you understand what your lender is expecting and what you can realistically afford. But you’ve also got to consider extras like closing costs and moving expenses.

Fortunately, there are plenty of ways to start saving for a house — but some of those methods are better than others. That’s why you need to make sure that you totally understand your needs and do your research before you start applying for mortgages or setting up brokerage accounts.

But if you’re looking for a way to generate passive income and make your money work harder, you should definitely explore Tellus. Download the app today.