Wealth Creation: Everything You Need to Know

Learn what wealth creation is, plus the steps you’ll need to follow to start creating and maintaining your own personal wealth.

True wealth is about having enough money to live the lifestyle that you want. To get started, you’ll need to know the 3 steps of wealth creation. Learn whether it makes more sense to pay down debt or build wealth first.

Living paycheck to paycheck or being in debt is stressful.

Wouldn’t your life be significantly better if you could afford to pay for the things you need without worrying about whether you still had enough money to cover the costs?

The problem is that nobody teaches us in school how to save money or how wealth creation works.

The good news is that it’s not too late to learn. Anybody can start building wealth.

In this article, we’re going to outline exactly what we mean by wealth creation. You’ll learn the three main steps you’ll need to begin creating wealth and the tools you’ll use to do it.

Contents

What is wealth creation?

If you look up the word wealth in the dictionary, it’s defined as an abundance of valuable material possessions or resources.

So wealth creation, then, is creating a state of material abundance for yourself.

In simpler terms, it’s about having all the money you need to meet your needs and live the kind of lifestyle you want.

Being wealthy doesn’t necessarily mean that you have to live in a huge mansion surrounded by hedges shaped like animals.

There’s a difference between being rich and wealthy. Plenty of people live a showy “rich” lifestyle with expensive jewelry and fancy cars but are actually in huge amounts of debt.

For you, wealth might be the ability to put your kids through college, buy a fishing boat, or achieve more long-term goals like a comfortable retirement.

Despite the old saying that “money can’t buy happiness,” studies show that your bank balance certainly impacts your life satisfaction, stress levels, and more.

The investor Warren Buffet once said, "if you don't find a way to make money while you sleep, you will work until you die.”

Wealth creation is about getting to the point where you make money in your sleep. But how is that sort of passive income creation possible?

For most people, it’ll require saving and investing.

How to start creating wealth

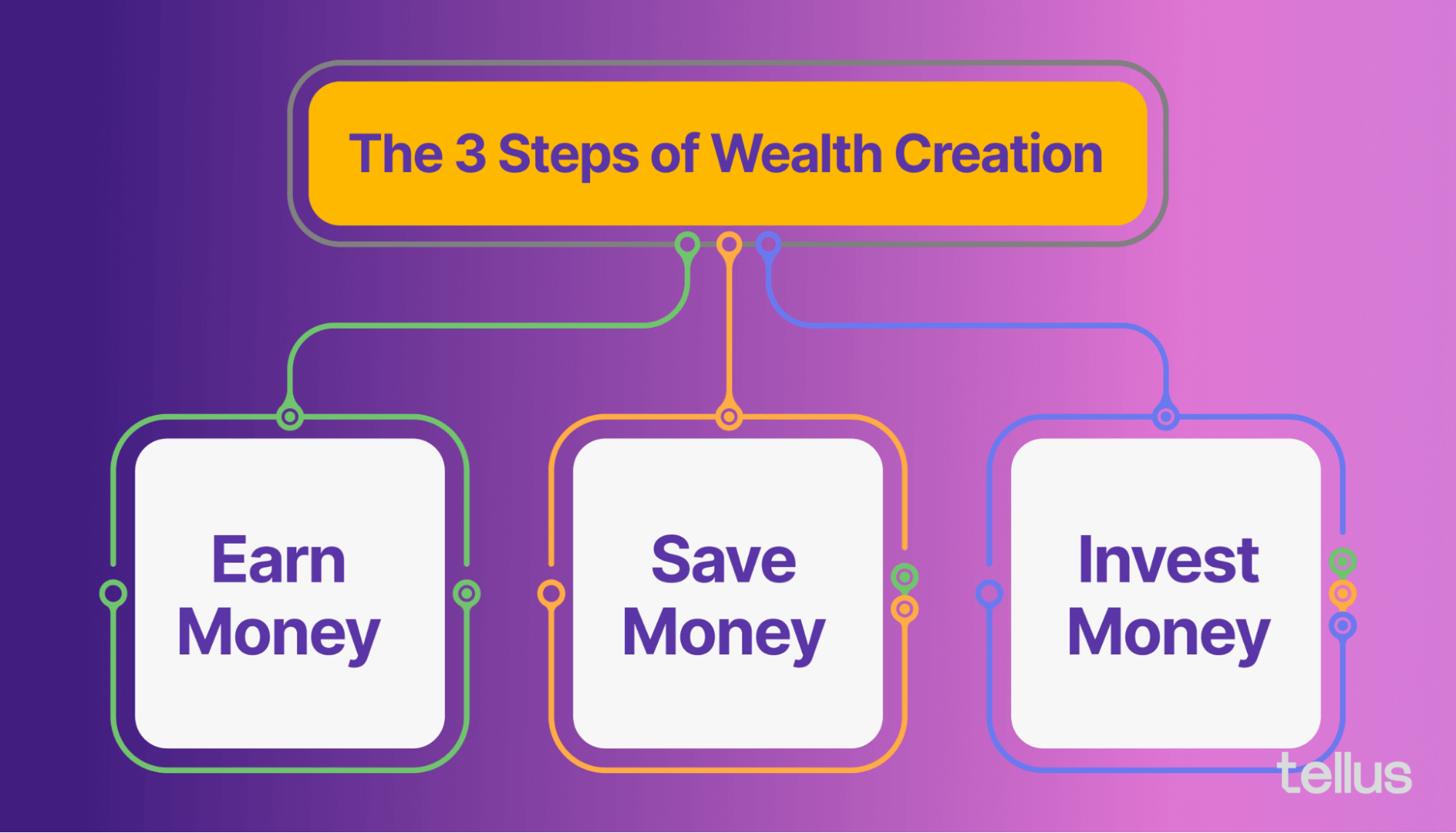

To start creating a meaningful amount of wealth for yourself, you’ll need to start consistently doing three things:

- Earn money

- Save money

- Invest money

Most people are doing one or two of these things but are lacking in another area. For example, you might earn money but have trouble saving it. Below, we’ll go over how to become an expert in all three steps.

Earn money

You’ve undoubtedly heard that “you’ve gotta have money to make money.” And it’s true. You can’t invest or grow your wealth if you don’t have some money to start with.

You’ve got to earn more money than you pay each month for all of your combined living expenses. That way, you’ll have some extra to set aside and start saving.

If you aren’t currently earning as much money as you’d like, here are a few options:

- Ask for a raise at work. It’s uncomfortable, but if a few minutes of awkward conversation leads to a 5% raise, that’s an extra thousand or more dollars per year.

- Find a better-paying job within your industry or change careers entirely.

- Start a side hustle or get a second part-time job. This can just be driving for rideshare or meal delivery apps, starting a podcast or Youtube channel, all the way up to building your own business.

- Sell extra things you own but don’t use on Facebook Marketplace, Craigslist, or eBay. eBay will allow you to list up to 250 items per month without paying a listing fee. So you don’t pay anything unless your items actually sell.

Save money

A big part of wealth creation is spending less than you earn.

You could be earning $150,000 per year. But if you’re spending all of the money you earn, you’re never building up any savings.

A great way to save money is by budgeting and cutting out unnecessary expenses.

If you don’t have the time or energy to earn more money, you can focus on cutting costs and working within your current income instead.

Start by setting a goal, like saving $200 per month. Then see what you can cut out of your budget to make it happen.

You can save money by focusing on wants vs. needs and being honest about what you could do without.

For example, look for cheaper alternatives to things that you’re currently buying. Buying groceries and cooking your own food is a lot cheaper than eating out most nights. And store brand products instead of name brand ones are often just as good, for less money.

You have to make your savings plan realistic, though. You don’t want to be so frugal that you cut out everything that brings you joy in life and end up miserable.

Once you’ve got money to spare, you can set up automatic payments from your paycheck or bank to set money aside each month without having to think about it.

The first priority for saving money is to ensure that you’ve got an emergency fund to cover your expenses for a few months. Then you can move on to the next step of starting to invest.

Invest money

Once you’re setting aside some extra money each month and have an emergency fund, it’s time to start investing and growing your savings.

Make sure to do your research before jumping into the world of investing. Don’t be afraid to speak to an investment advisor or someone at your bank for advice before risking your hard-earned money.

And, of course, avoid get-rich-quick schemes or anything that seems too good to be true.

Investing is all about balancing risk vs. reward.

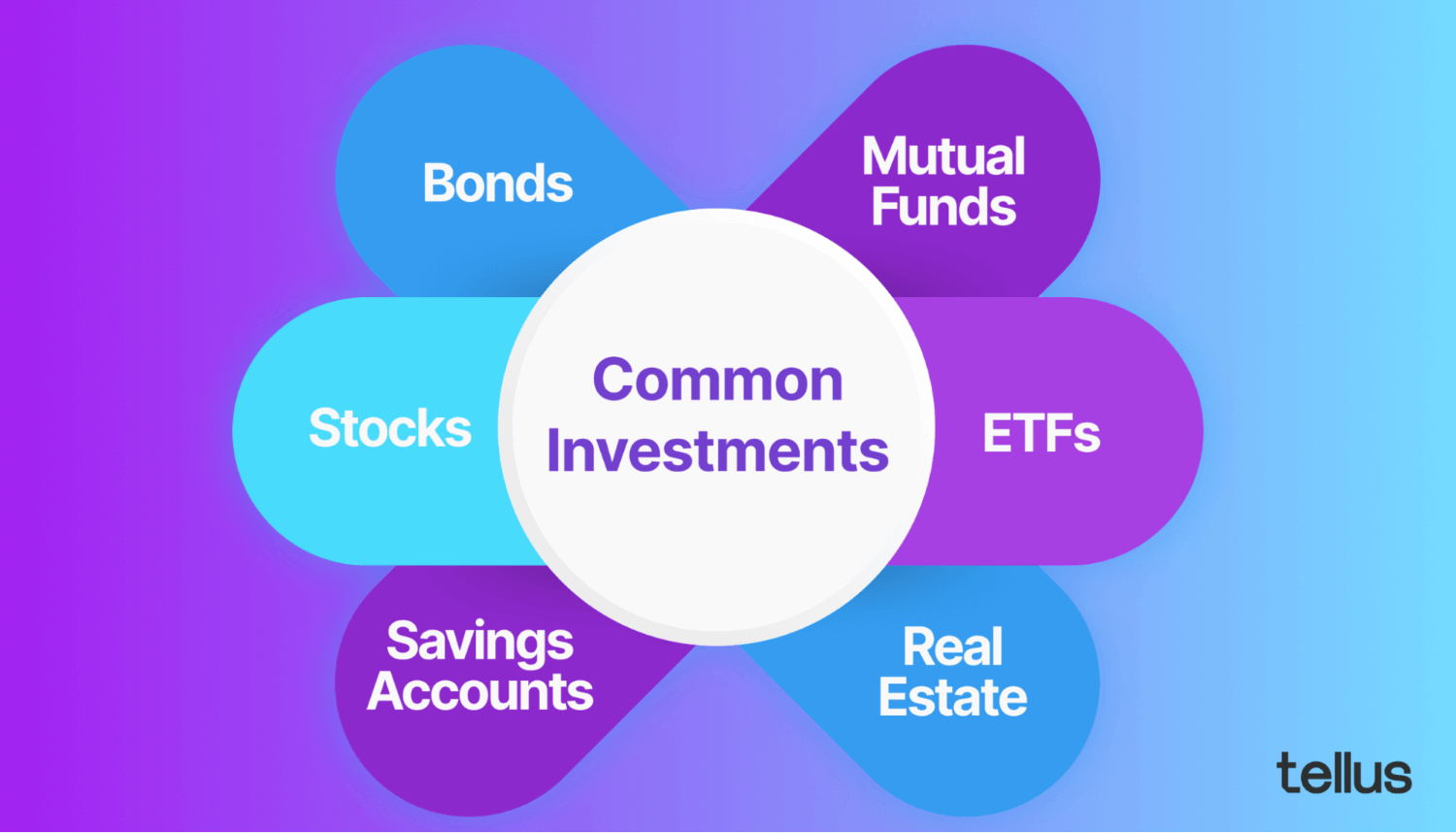

To earn a high rate of return on your money, you’ll probably need to take on some risk by investing in things like stocks, ETFs, and mutual funds. But most people have a low to moderate risk tolerance and should avoid putting large amounts of their money into high-risk investments like cryptocurrency, forex, or penny stocks.

If your money is in the stock market, a 10% return on your investment is considered good.

Less risky types of assets like bonds have a return of around 2% to 5%.

A critical long-term investment strategy is to diversify. Don’t put all of your eggs in one basket.

Dollar-cost averaging is another important investment strategy. Putting a little bit of money into investments every month, regardless of whether they’re up or down, will usually beat trying to time the market.

Tools for wealth creation and maintenance

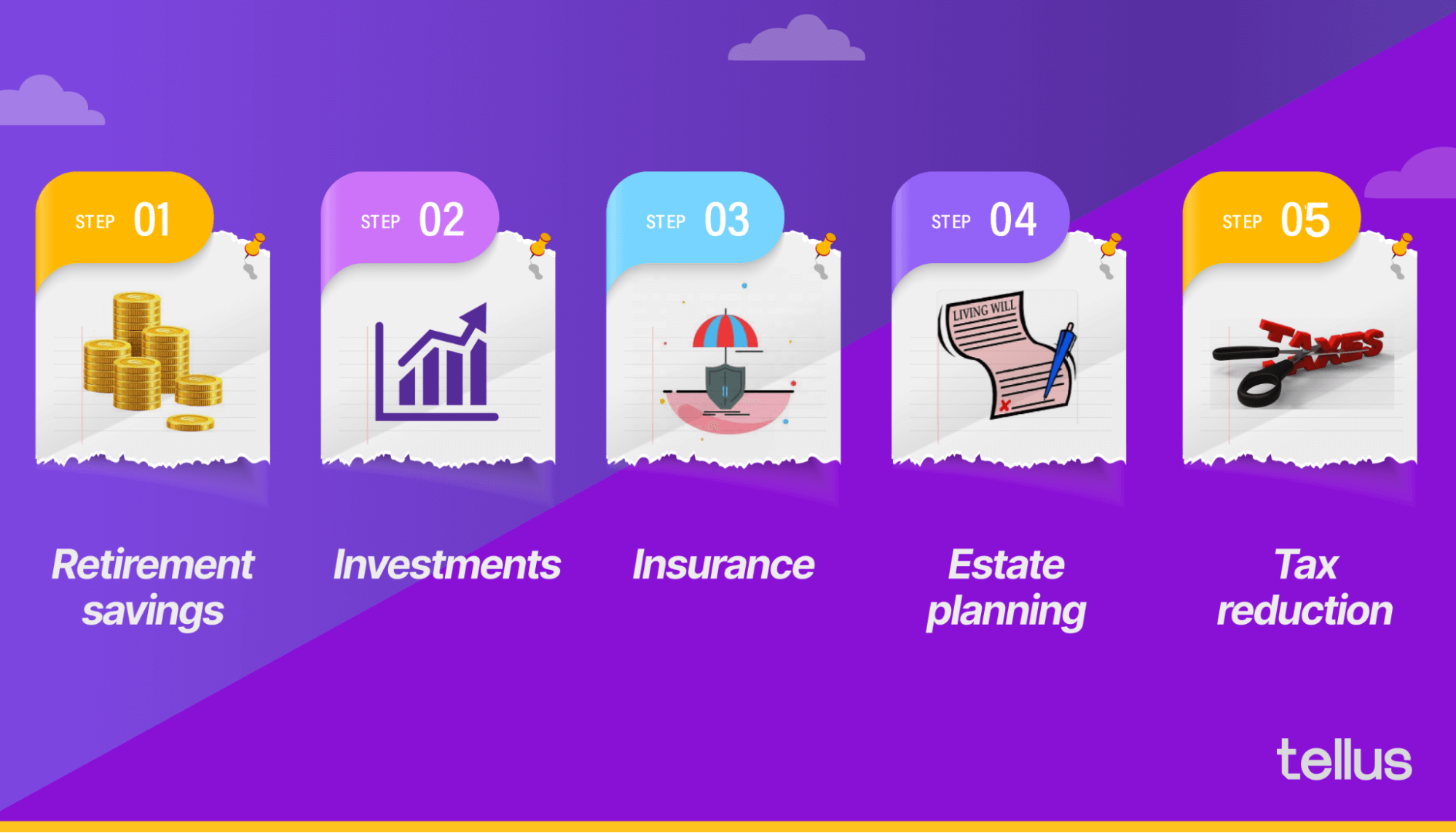

There are a number of different tools and wealth creation accounts, depending on what your goals are.

This topic is too complicated to cover in-depth here, and we could write several pages about each of these on their own. But we have full articles on our blog devoted to several of these topics that you can check out for further reading.

- Retirement Savings - 401k, Traditional IRA, ROTH IRA.

- Investments - Bonds, stocks, mutual funds, ETFs, real estate, and more.

- Insurance - Health, life, home, and auto insurance to plan for the unexpected.

- Estate planning - Creating a will to ensure your money will go where you want it to go after your death.

- Tax reduction - Talk to an accountant. The options available to you will largely depend on where you live and the types of jobs, investments, or businesses you’re involved in.

Should you reduce debt or start building wealth first?

Once you start saving, you might wonder if it makes more sense to use that money to pay off existing debt or to start building wealth instead.

It really depends on your specific situation and the types of debt you’ve got. Not all debt is created equal.

For high-interest debt, like credit cards, where you might be paying 20% or more in interest, you'll want to prioritize paying it off.

For other kinds of debt, like a mortgage with a low interest rate, it might be better not to rush to pay it off, especially when there’s an asset (your home) backing the mortgage that’s also probably appreciating in value over time.

You’ve got to compare the APY (annual percentage yield) you’re expecting to earn from your investments against the APR (annual percentage rate) you’re being charged on your debt.

If your investments earn a higher rate, then it makes sense to invest and only make regular payments on your debt. The money you’re earning is more than the money you could be saving if you paid off your debt early.

If your debt has a higher interest rate than you can earn from your savings, then it makes sense to pay off your debt before using the money to build wealth.

Whichever route you go, the end goal of wealth creation for most people is usually to be debt-free.

For more information on this topic, check out our article Should You Pay Off Debt or Save?

Let go of limiting beliefs about wealth and money

Sometimes, having the wrong mindset can be enough to hold us back from achieving wealth and prosperity in our lives.

You’ve probably heard stories about people who won the lottery, only to lose all of their wealth again within a couple of years.

If you want to create lasting wealth, you need to create the right mindset.

A major part of that mindset is letting go of negative or limiting beliefs about money that might be holding you back.

These include common sayings or beliefs you might’ve heard family members or other people say growing up, such as:

- The rich get richer, and the poor get poorer

- Money is the root of all evil

- Only those who come from rich families can have wealth

- If I have money, I should spend and enjoy it right away

- More money, more problems

- Wanting to be wealthy is selfish, greedy, or wrong

- I don’t deserve to be wealthy

- I’m just not good with money

The truth is that money is just a tool that can be used for good or evil. It’s all about how you choose to use it in your own life.

You can create wealth for yourself and still be a person who gives generously to charity and supports those in need. Having more wealth will actually enable you to be in a position to give even more than you otherwise would.

Managing money and building wealth is a set of skills that anyone can learn. And once you master these skills, it will only open up more opportunities and options for you.