Here's how much money you should have saved by 30

This guide explains why it’s important to save for your 30s (and beyond), how much money you should have saved by 30, and the tools you can use to start saving for (or even during) your 30s.

Your 20s are an incredibly formative decade. A lot of us finish college and start a career, find new passions, consider starting a family, try to get on the property ladder — the list goes on.

But while you’re out there finding yourself and kickstarting your life, it’s easy to forget how important it is to kickstart your savings, especially if you want financial freedom in your 30s and beyond.

With the rising cost of living, trying to save money while staying afloat and living your life can feel a bit daunting. But the truth is, there are plenty of fairly simple, tried-and-tested strategies out there designed to help you save for your future financial goals.

More importantly, there are a number of savings vehicles and investment products worth checking out that can help you start building your nest egg now — so that, by the time you’re 30, you and your family are in a pretty good position financially.

This guide explains why it’s important to save for your 30s (and beyond), how much money you should have saved by 30, and the tools you can use to start saving for or even during your 30s.

Why should you start saving before you’re 30?

Before we get into how much you should have saved by the time you’re 30 (and the tools you can use to build that savings), let’s pump the brakes and talk about why you should be saving.

Now, don’t panic if you’re in your mid-20s and haven’t started saving yet. It’s not too late. But the fact of the matter is that your 30s are probably going to be an expensive decade. More importantly, they tend to be pretty critical in terms of setting yourself and your family up for the future.

That’s why you definitely want to start making your money work harder for you by the time you hit 30.

Let’s chat numbers. First, there’s family building. We understand the linear family model has evolved quite a bit — but according to the US Census Bureau, the median age for marriage in America is still 29 for men and 28 for women.

And research from the National Association of Realtors says that the median age for first-time homebuyers in the US is now 33.

And if you’re considering getting married and buying a house, chances are that kids might be in the cards, too (if they haven’t popped up already).

No matter what your finances look like or your future plans, there’s no dancing around the fact that your 30s are statistically going to be costly. Worse yet, it appears that most twenty-somethings aren’t anywhere near ready for those expenses.

According to a 2022 survey from Bankrate, only 41% of millennials had enough savings to pay for a surprise expense of up to $1,000. Worse yet, inflation has weakened what little spending power many of us had. That same survey found that 54% of people in their 20s and 30s admit to dipping into their savings accounts to pay for everyday expenses.

But saving in your 20s isn’t all about the immediate future, either.

This is also when you should start thinking about your future retirement. That means taking advantage of an employer-based retirement program, putting money aside, or opting for another long-term investment vehicle that can help you build compound interest over time.

If you’re new to the concept of compound interest, it’s essentially when the interest you earn on a balance in a savings or investment vehicle gets reinvested — earning you even more interest.

For example, let's say you put $1,000 into an account that pays you 3% annual interest. That'd earn you $30 worth of interest after 12 months. But thanks to compound interest, you'd then earn 3% interest on your principal amount plus interest ($1,030). That means you'd get paid $30.90 worth of interest the following year.

We understand that doesn’t sound like a lot. But if you’re putting away thousands per year, it’s all going to start to add up pretty quickly. Compound interest is essentially free money — and if you start saving in your early 20s, it’s going to give your savings a major boost by the time you’re 30.

There are also tax benefits and usually higher returns in some saving vehicles like the 401(k). Savings added in your 20s get extra decades to compound compared to anything you add in your 40s and 50s. That’s why it’s critical you start saving as soon as you can.

How much money should you have saved by the time you're 30?

Before we start talking numbers, it’s important to bear in mind that there’s no one-size-fits-all amount when it comes to what a 30-year-old’s savings account should look like. The amount of money you should have saved by the time you’re 30 will depend on your income, lifestyle, savings goals, plans for the future, and everything in between.

That’s going to include things like where you live, whether you’ve got kids, whether you rent or pay a mortgage, how you like to shop, whether you own a car, and a million other things. Everybody will have their own magic number that they’ll need to work out for themselves.

That being said, it’s worth looking at some averages as a point of reference.

According to the Federal Reserve’s Board Survey of Consumer Finances (SCF), the average savings balance for people under 35 was $11,200 in 2019. But again, you’ve got competing interests you have to be saving for — so let’s dig a little bit deeper into those interests and how much experts recommend you put into each pot.

Creating an emergency fund

As a general rule of thumb, financial experts say that you should always have at least three to six months’ worth of living expenses in an emergency fund. To find your target amount, you’ll need to sit down and list all of your essential monthly expenses. Multiply that amount by either three or six, and that’s how much you should try to maintain in that fund. Note: Don’t rely on credit cards and loans to fund your emergency fund, especially during a time when the Fed is raising interest rates. This can lead to a pile of debt that can be fairly difficult to pay off.

This fund needs to be accessible at the drop of a hat, and its exact size is going to fluctuate up and down over the years depending on what your monthly expenses look like.

If you’re one of the many Americans without an emergency savings account, don’t panic. You don’t need to build an emergency fund overnight. Start by setting up a dedicated account in which you can consistently deposit whatever you can afford on a monthly basis. This is where micro-saving strategies can be a real lifesaver — but we’ll talk more about savings tools and strategies in just a minute.

Saving for retirement

Retirement might seem like a zillion years away when you’re in your 20s, sure. But if you want to build a big nest egg and benefit from the power of compound interest throughout your life, you have to start saving early.

Pension providers normally recommend you have the equivalent of your annual salary saved by the time you hit 30. That means if you earn $75,000 per year, you should have $75,000 sitting in your retirement fund by your 30th birthday.

Before you start to panic, this amount doesn’t refer to how much cash you’ve got sitting in a jar on top of the fridge.

It includes all the funds you’ve allocated for retirement, which will often go into a company pension scheme, 401(k), Roth IRA, or anywhere else. Because many of these investment vehicles invest your money in stocks and index funds, your retirement savings balance will normally be higher than the amount of cash you originally invested.

Even so, pension providers estimate you need to save at least 15% of your annual income toward your pension to reach this retirement goal.

How to start saving before you’re 30

We’ve covered why you should start saving for your 30s and how much you should save. Now, let’s talk about ways that you can actually achieve those savings.

There are plenty of options out there, but we’ll walk you through three tried-and-tested ways to generate savings for the future.

Use the 50-30-20 rule

With the rising cost of living, one of the hardest parts of saving for the future is simply finding enough money each month to put away. That’s where the 50-30-20 budget rule comes to the rescue.

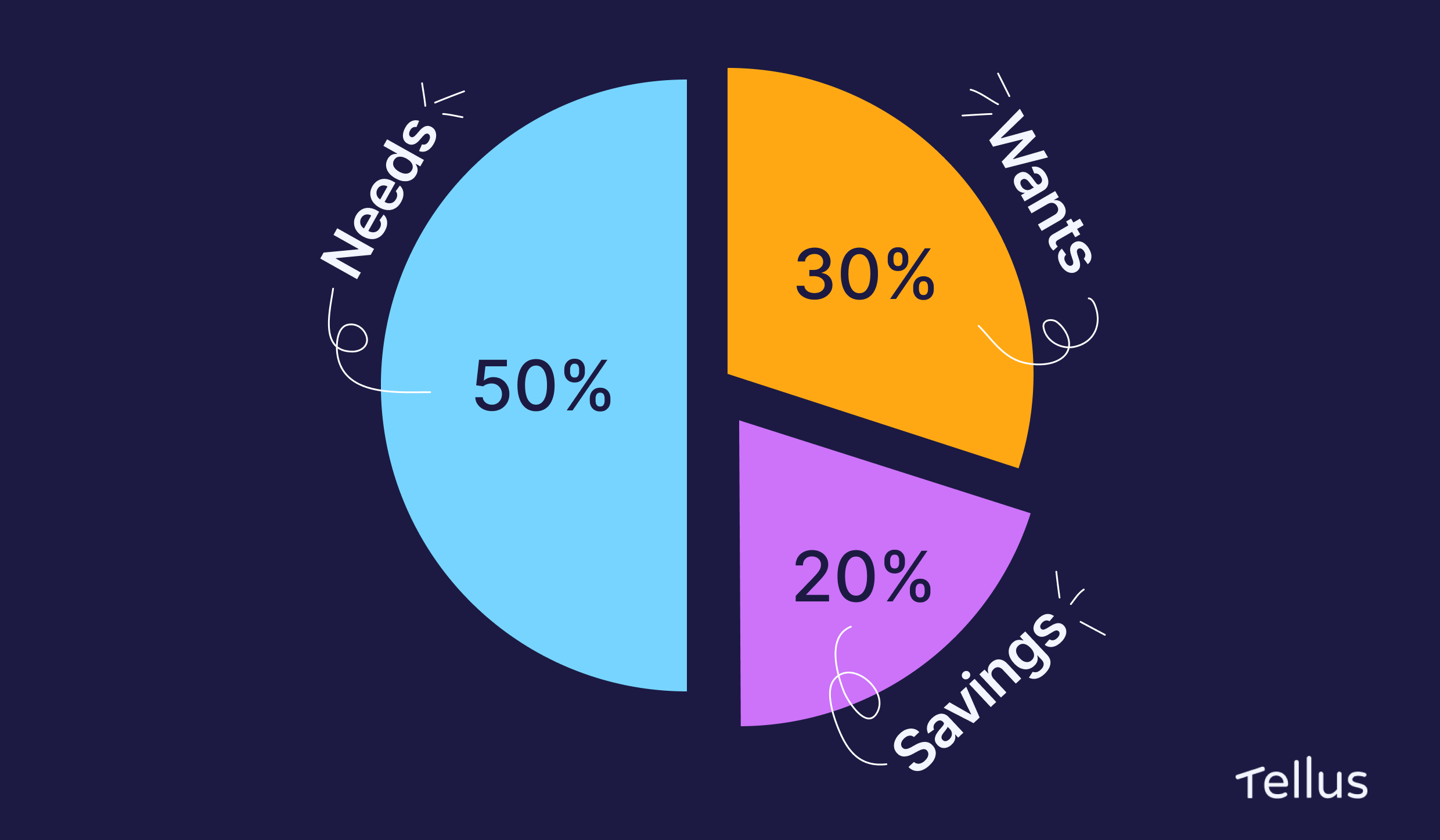

The 50-30-20 rule is a way to manage your money in which you divide your annual income (or monthly income) into three categories: 50% on needs, 30% on wants, and 20% on savings or debt.

That 50% will need to go toward non-negotiables like rent or your mortgage payment, household bills, transportation, and food. Your 30% should then be used for discretionary spending like shopping, eating out, trips, and stuff like streaming subscriptions.

Finally, you should reserve 20% of your monthly income to pay off debt like student loans, credit card payments, or car loans beyond the minimum payments or place what you can into a savings account, investment account, or pension fund.

If you look at your outgoing expenses and think it’s impossible to earmark 20% of your income to save, this is where you have to reassess your expenses and try to cut back.

It’s by striving to save 20% that you’re ultimately going to start building your nest egg for the future. But where you place that 20% depends on your savings goals.

Set up a 401(k)

If you’re new to the idea of a 401(k), it’s basically just a retirement plan you can use to invest in over time.

Many people choose to save using a 401(k) because all contributions are pre-tax — which means they don’t count towards your taxable income when you file taxes at the end of the year. Better yet, everything in your account will grow tax-deferred so that you don’t pay any taxes on the money until you withdraw it after retiring.

There’s some fine print here, though. You’ve got to wait until you’re 59 to make withdrawals, and you’ve got to take out a required minimum.

You’ll also hear 401(k) plans get referred to as “defined contribution plans.” That’s because they don’t guarantee you a set level of income. Instead, the responsibility is yours to save money in the plan.

Many employers offer matching bonuses for 401(k) plans, which means they’ll put money into your account for each dollar you contribute. Those contributions usually get capped as a percentage of your salary, but they’re essentially free money. That makes the 401(k) plan an incredibly popular way to start saving in your 20s and 30s.

Conclusion

At the end of the day, you should always be prepared for an emergency, and you should always be working to preserve your (and your family’s) financial future. That’s why you have to be saving — especially before you hit 30.

How and where you save your money for the future is going to depend on your short-term and long-term financial goals. As a result, it’s important you understand the options available to you and how to use those savings vehicles. But if you’re looking for a way to generate passive income and start making your money work harder (so you don’t have to), you should definitely consider setting up a Tellus account.

Ready to get started? Download the Tellus app today.