How Much Do Americans Have Saved By Age?

See how your average savings compare to Americans your age.

The amount of money you should have saved based on your age will depend on your income, lifestyle, savings goals, and plans for the future. According to the Federal Reserve, the average American has almost $42,000 in savings, but that can be skewed by high-net worth individuals. The median savings balance of Americans is just $5,300, and even less for those 35 years old and younger.

Table of Contents

Do you feel like you’re behind on saving money? Whether it be for emergencies or retirement, most people are. The median savings for the average American family is just over $5,000. And families are saving less than ever. Americans are saving just 5.4% of their disposable income — the lowest level since the Great Recession.

While you may think making more money is the secret to boosting your savings, the truth is, it might not be. Lifestyle creep happens — the more money you make, the more money you spend. You can combat this, however. Individuals with a simple savings strategy save more — meaning they’re more likely to stick to their plan through thick and thin because it’s easy and automated. In fact, according to MoneyHelper (formerly National Savings and Investments), people with a savings goal save faster and up to £550 a year more than people who don’t.

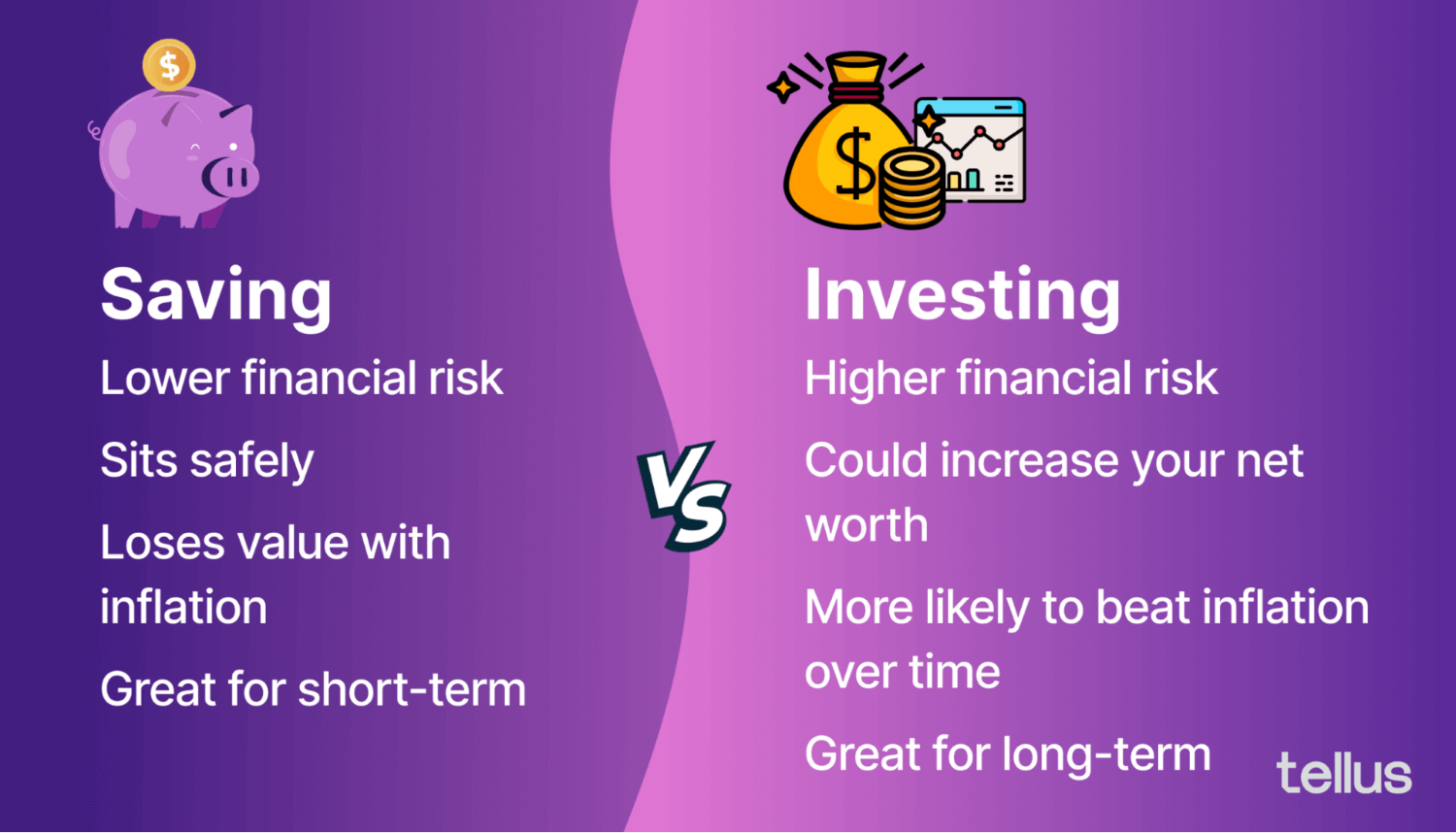

That doesn’t mean you have to be 100% invested in the stock market or settle for near 0% interest in a savings account — there are ways to avoid market fluctuations and risk and still optimize your savings.

Average savings by age

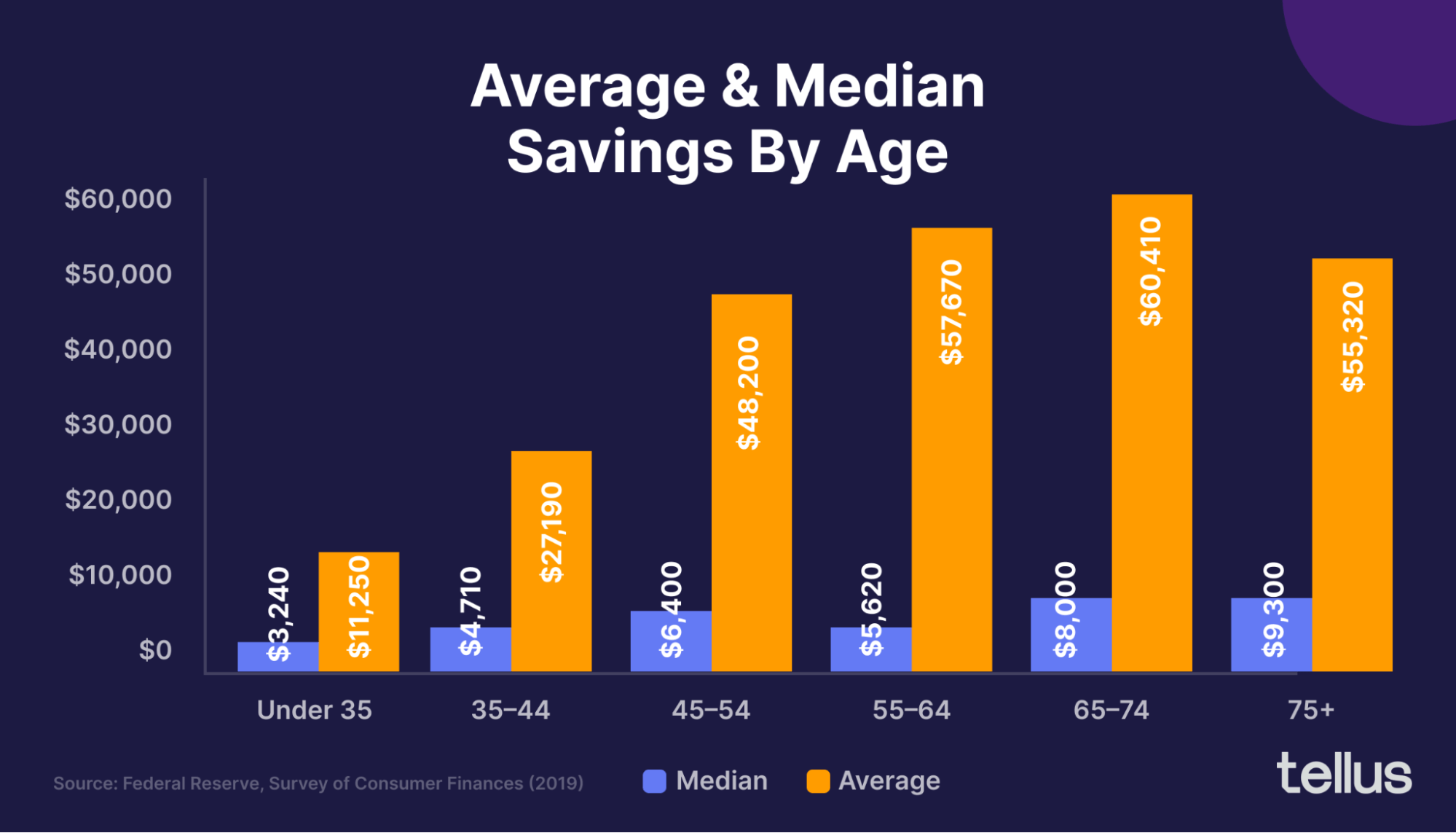

According to the Federal Reserve’s 2019 Survey of Consumer Finances report, Americans had an average savings balance of $41,600. Note that savings doesn't include retirement or investment accounts, but only what Americans hold in checking and savings accounts.

A newer study by Northwestern Mutual found that the average savings was up to $62,000. However, ultra-high-net-worth individuals are likely skewing these averages. The median balance is likely a better indicator of how much the average American has saved. The Fed’s report found the median savings was $5,300. Below, we break down the average and median savings of Americans across six age groups.

35 years old or younger

Median — $3,240

Average — $11,250

Americans 35 or younger had an average of $11,250 in their savings — the median amount was $3,240. The 35 or younger group is the lowest of the six groups, but it does include teenagers, which can skew the numbers.

It can be difficult to manage your money as a college student or new professional, and you’re still likely working on those pesky student loans, so it makes sense that this number is low. However, thanks to President Joe Biden’s student loan forgiveness plan, young professionals may be able to boost their savings goals in the coming months and years.

35 to 44 years old

Median — $4,710

Average — $27,190

This group had an average of $27,190 in savings — the median was $4,710. This number likely reflects the higher wages that this group is earning (compared to those 35 and younger) and the need for greater savings to plan for emergencies.

However, the lack of savings relative to the next group (45 to 54 years old) is due, in large part, to first-time home buying. The typical age of first-time homebuyers is 33 years old, the oldest since 1981.

45 to 54 years old

Median — $6,400

Average — $48,200

Those between 44 and 54 years old had an average savings of $48,200, with the median at $6,400. Here, individuals are moving past mid-life, and likely making more money, but could also be paying for higher education expenses for their children.

55 to 64 years old

Median — $5,620

Average — $57,670

The average savings of those 55 to 64 years old was $57,670, and the median was $5,620. These individuals are entering retirement (or very close) and are likely tapping into savings to fund pre-retirement expenses and increased medical costs.

Much of this group is younger than the 59½ age limit for penalty-free withdrawals from 401(k)s and individual retirement accounts (IRAs). They're also younger than the full retirement age for Social Security benefits — meaning they are relying more on savings account balances to get them to retirement.

The 55 to 64 year old age group is likely sacrificing short-term savings to take advantage of the catch-up contributions (50-years old and older) for their retirement accounts.

65 to 74 years old

Median — $8,000

Average — $60,410

This group had the highest average savings at $60,410, and the second highest median at $8,000. Many people in this group are now able to move money stocking their savings accounts for near-term retirement costs.

This group is also starting to receive Social Security payments.

75 years old and older

Median — $9,300

Average — $55,320

Americans above the age of 75 had an average savings account balance of $55,320 and a median balance of $9,300. Retirees pulling money from their retirement accounts will stash the money into their savings to fund interim living expenses.

How much should you have saved for retirement?

As noted, savings are different from retirement savings. The latter is meant to fund your life after you quit working. This number should be much larger than your savings. As a result, it takes a bit more planning and discipline to build your desired nest egg.

Figuring out your retirement number (the amount you need when you retire) can be cumbersome. However, many financial experts look to simplify this calculation as much as possible. That way, you have a goal to work toward without having to consult a financial advisor or make predictions about decades in the future. The general rules of thumb for targeted retirement savings are:

- 1 to 2 times the annual salary for those in their 30s

- 3 to 4 times the annual salary for those in their 40s

- 6 to 7 times the annual salary for those in their 50s

- 8 to 10 times the annual salary for those in their 60s

For example, a 35-year-old making $60,000 a year should have around $90,000 in their retirement accounts — roughly twice what the average person in their mid-30s has saved for retirement.

Of course, these aren't hard and fast rules, merely guidelines. Your exact numbers will vary based on your current and planned post-retirement lifestyle.

How much money will you need to retire?

Another way to estimate needed retirement savings is to assume what percentage of your pre-retirement income you’ll need to live on during retirement — and then work backward. You’ll have to make some key assumptions, such as the average return for your investments and life expectancy, but it’ll give you a more customized target.

Example: Susan is 29 years old and plans to retire at 67 years old. Her life expectancy is 93 years old. She currently makes $55,000 a year and plans to spend roughly 70% of her pre-retirement annual income during retirement. To fund her retirement, she’ll need to have accumulated $1.7 million by the time she retires.

To achieve that goal, she plans to put 10% of her annual income into retirement savings. She currently has $10,000 saved for retirement and assumes that her investments will grow at an average annual rate of 8%. With this plan, she’ll have accumulated the needed $1.7 million upon retirement. Note that this example doesn't include other income, such as Social Security benefits. If Susan assumes she can collect $1,600 a month in benefits, she’ll only need to have saved $500,000.

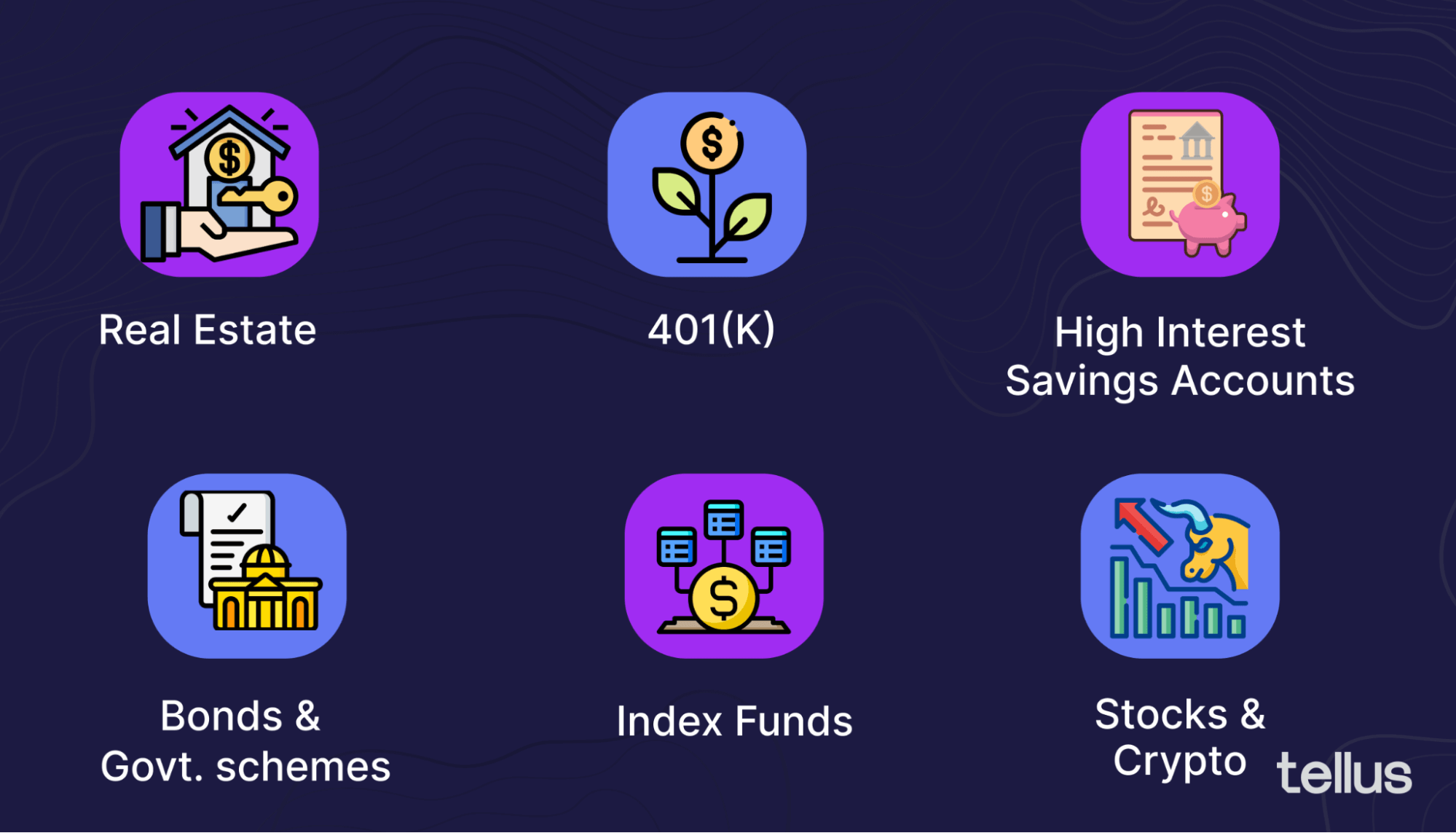

Where should you be saving/investing for your retirement?

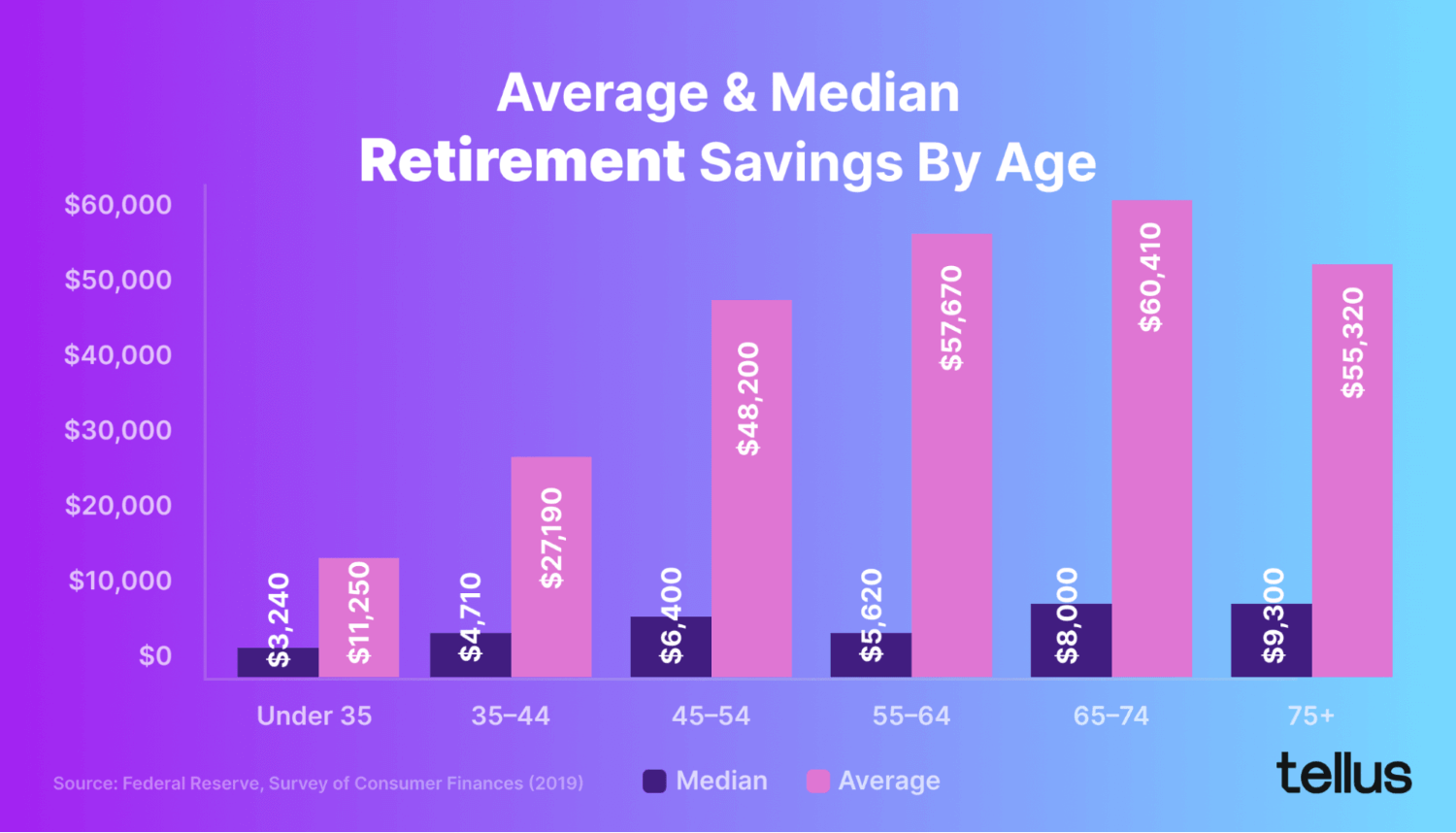

When preparing for retirement, getting started early is key, but many Americans are woefully behind on saving for retirement. For example, the average 40-year-old should have roughly 3 to 4 times their annual income saved for retirement.

If their income is $85,000, that means $255,000 to $340,000 in retirement savings. However, the average 40-year-old has around $132,000 saved. Below is a breakdown of the average retirement savings based on the Fed’s report.

Saving for retirement: 34 and younger

Median — $13,000

Average — $30,200

Americans 34 years old and younger had an average of $30,200 in retirement savings — the median balance was $13,000. Many individuals in these age brackets are just starting their careers and are often not concerned with retirement. The power of compound interest means that every dollar you invest in your 401(k) at this age will grow more than any later investments you make.

Also, this is the best time to be aggressive and embrace a higher risk tolerance, as time is on your side, so going beyond the 401(k) and investing in an index fund, individual stocks, or taking a risk on some crypto could make sense.

Savings that aren’t for retirement should be in less volatile and easier to access vehicles, like a high-interest savings account.

Saving for retirement: 35 to 44

Median — $60,000

Average — $132,000

This group had an average of $132,000 in their retirement accounts — a median of $60,000. As you get older, your income will likely increase, but so will your expenses. During your 30s, you’ll likely still be paying student loan debt while paying for weddings, buying homes, and having children.

Still, you should be putting more money away — upwards of 15% of your income toward retirement while also taking advantage of your employer’s 401(k) match.

Saving for retirement: 45 to 54

Median — $100,000

Average — $254,700

Your retirement savings should be steadily rising into your 50s, but you likely still have a mortgage and college tuition. By now, however, most people are in their prime earning years and should be gearing up their savings even more — investing $1,000 or more a month into retirement savings.

Saving for retirement: 55 to 64

Median — $134,000

Average — $408,400

Into your 60s, you may still be paying college education costs for your kids but are likely facing higher medical costs. However, most individuals now realize that retirement is in sight. Savings rates tend to go up as many look to play catch-up — hence the allowed catch-up contributions for certain retirement accounts, such as 401(k)s and individual retirement accounts (IRAs).

The difference in time frame means that it makes sense to balance out more volatile investments with more secure (and more accessible) options like a high-yield savings account, starting at around this age range.

Saving for retirement: 65 to 74

Median — $164,000

Average — $426,100

Americans 65 to 74 years old had an average of $426,100 in retirement savings and a median of $164,000. Needing to build at least eight times your annual income at this point — that’s $525,000 if you’re making $75,000 a year — means additional strategizing if you’re falling short. That means you may need to work for a few more years or part-time during retirement. It could also mean monetizing or selling major assets, such as a vacation home.

Saving for retirement: 75 and older

Median — $83,000

Average — $357,900

Here, you’re putting your retirement savings to work, hence the drop-off in balances — the average balance of $357,900 and a median of $83,000. The biggest thing in this age bracket is to make sure you don’t outlive your investments while also sticking to relatively safe investments.

Importance of saving for the future

Needing hundreds of thousands of dollars by the time you’re 65 or 70 seems overwhelming — even daunting. However, time and compounding interest are on your side, even if you’re getting a late start — as many Americans are.

When it comes to saving, the sooner, the better — the longer you can give your money to compound, the better. Compound interest is when you earn interest on interest. Albert Einstein famously called compound interest the eighth wonder of the world.

Warren Buffett attributes much of his $100B net worth to compound interest (along with lucky genes).

Every little bit helps

Even just increasing your retirement savings rate by 1% can make a big difference in the long run. For example, say you have an average annual salary of $80,000 over the next 20 years. Let’s assume you’re putting away 5% of your gross income for retirement. Assuming an 8% annual return, you’re looking at roughly $183,000. Now, if everything stayed the same but you put away 6% of your income over those years, you’d have $219,700 — a difference of over $36,000, just for investing an extra $67 a month.

The importance of saving for retirement extends to saving for life in general. Life happens fast — having a baby, funding college tuition, car repairs, etc. — and people are living longer than ever. Over 30% of all Americans don’t have enough savings to cover a $400 emergency, while more than half of Americans wouldn’t be able to pay an unexpected expense of $1,000.

How much should you keep in savings?

Figuring out exactly how much savings you need can be tricky — you don’t want to under-save and end up with too little money. But you also don’t want to perpetually over-save and miss out on life.

The biggest part of your savings may be your emergency fund, which will cover all your expenses for a certain timeframe (generally 3 to 6 months). But it’s also there in case there’s an unexpected car repair or hospital bill.

Note that your savings are different from your retirement savings. Retirement savings aren’t easily accessible, and any withdrawals pre-retirement will likely come with penalties.

Tips for maximizing your savings

It’s never too late to start saving. Here are some key tips to help maximize your savings capabilities. Start with a budget — but make sure it’s one you’ll stick to. The simpler, the better. One popular budgeting framework is the 50/30/20, which suggests you use your take-home pay as follows:

- 50% for needs — housing, food, utilities, transportation, etc.

- 30% for wants — travel, entertainment, dining out, gadgets, etc.

- 20% toward savings and debt — retirement accounts, emergency funds, etc.

For example, Anna is 31 years old and makes $60,000 per year. Based on the 50/30/20 budget, her spending per month should be $2,500 on needs, $1,500 on wants, and $1,000 on savings and debt repayment.

Another budgeting hack is to make sure you’re paying yourself first — also known as reverse budgeting. Here, you start with your take-home pay and subtract your desired savings. Then, you build a budget based on what’s left.

Where to put your emergency cash

When looking for places to put your emergency fund, make sure it’s readily accessible and generates some interest. Savings accounts are great, but they offer dismal interest. Certificates of deposit (CDs) offer better rates but little liquidity. But, consider this — there are ways to keep your liquidity intact while earning literally hundreds more in interest.

The solution? Say you have $10,000 in your emergency fund. You need that cash readily accessible; thus, most people park it in a high-yield savings account. For that privilege, your bank only pays a nominal yield — 0.17% on average. That’s $17 a year on your $10,000.

Automate, automate, automate

One of the best budgeting and savings hacks is to put your savings on autopilot. That way, there are no excuses for delaying a transfer or investment.

Automate your savings. Scheduling automatic allocations from your monthly income to either a savings account, cash account or retirement plan can help you make sure you are contributing to your savings regularly.

With Tellus, setting up recurring transfers takes just seconds, with help from Tellus’ partners, Plaid and Stripe.

Take advantage of your options

Use the various savings products at your disposal, such as bucketing your savings — setting up separate accounts or “buckets” for certain purposes or goals. For example, put away money for certain major expenses, such as a car down payment or vacation, into sub-accounts or separate savings or cash accounts.

Conclusion

Sometimes, simpler is better. That is, a simple plan is better than no plan or a complicated plan you can’t stick to. And sometimes, “not” being 100% invested is a good thing. But you can still watch your money grow while staying away from the risk of losing money — all while making sure you have the financial ability to navigate any curve balls life throws at you.