52 Week Savings Challenge

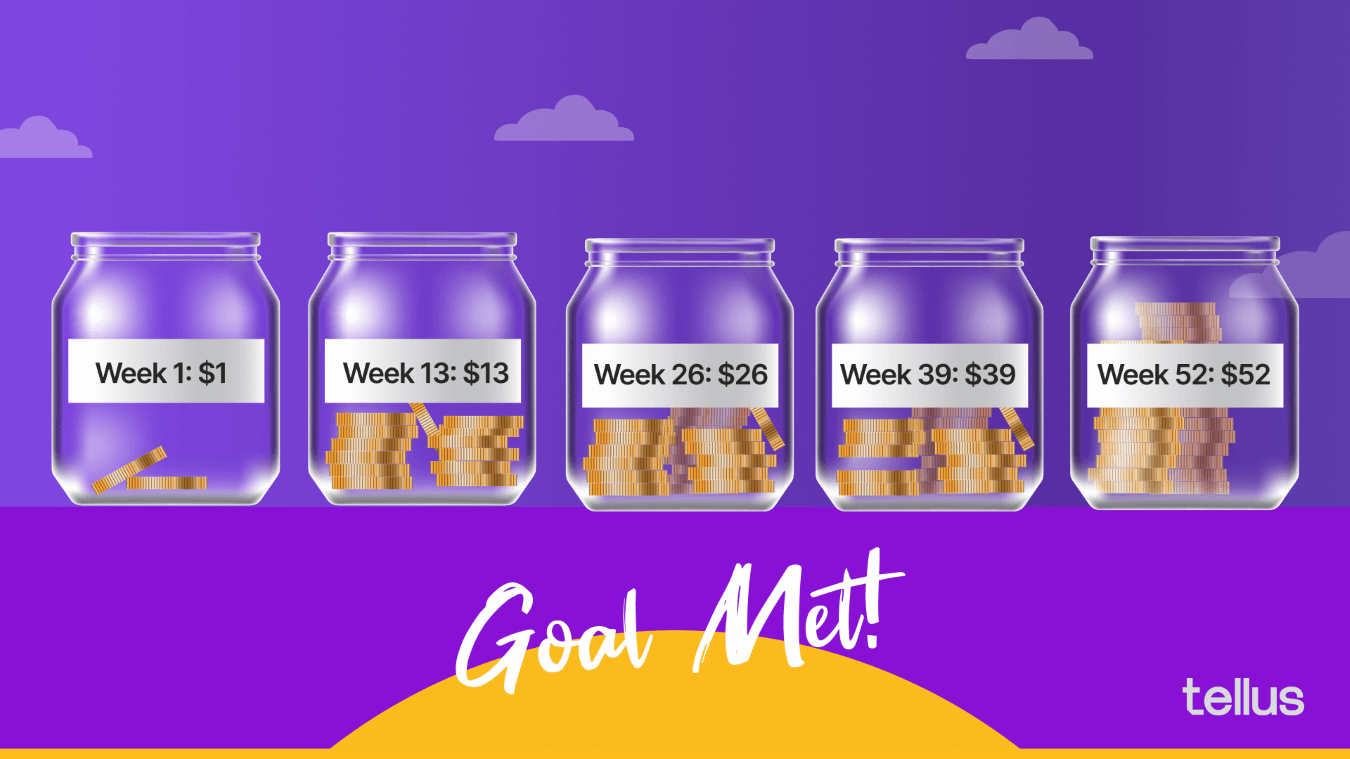

The 52 week savings challenge involves saving $1 in the first week and then increasing the amount by $1 every week, ultimately accumulating $1,378.

The 52 week savings challenge will help you save $1,378 over the course of a year. The plan involves starting with saving $1 the first week, and then increasing the amount you save by $1 every week for 52 weeks. However, it can be customized to meet your savings ability and goals.

Getting started with a new habit can be difficult, especially a savings habit. Think of the last New Year’s resolution you set. How long did it last? Did you make it halfway through the year to July? Or did you fail to make it out of January? The secret to forming a new habit is to make it as easy as possible.

The 52 week savings challenge is sound and simple way to get started. During the year, you build momentum by increasing your savings by just $1 weekly. Here’s how to do a 52 week savings challenge.

Contents

What is the 52 week savings challenge?

The basis of the 52 week savings challenge is that you start by saving $1 the first week, then increase it by $1 every week after. At the end of a year, you’ll have saved $1,378. The simplicity of the 52 week money savings challenge makes it easy to find the money to start a savings plan. It’s also highly customizable so that it can grow with your income and goals.

How the 52 week savings challenge works

The 52 week savings challenge is as simple as adding $1 to your weekly savings amount. The first week it’ll be $1; the second week, it’s $2; the third week, it’s $3; and so on. An easy way to figure out how much you need to save for a particular week is to look at the corresponding week number. For example, in week 38, the savings amount will be $38.

Benefits of the 52 week savings challenge

The 52 week savings challenge helps boost financial confidence and is an easy introduction to setting a savings plan and sticking to it. It’s also highly customizable. You can change the challenge to meet almost any savings goal. You can adjust the amount you save or the amount that you increase your savings by each week.

For example, if you have bigger goals, you can double up your 52 week challenge by saving $2 in week one and adding $2 per week each week. So you’d save $104 in week 52 and have a total savings of $2,756.

You’ll get plenty of budgeting practice by using the 52 week savings plan. And although it may require some adjusting, such as spending, it'll force you to create a budget. However, to make it easier, you can set up 52 automatic recurring deposits or transfers with the set amount (one for every week) at the start of this challenge.

Weekly deposits into a savings or cash account will also earn money versus monthly deposits. The quicker you deposit your savings into a savings or cash account, the quicker it’ll start earning interest.

For example, if you’re looking to save $10,000 over a year. You could set up a monthly transfer of $833 to your savings account at the end of each month. Or you could make a weekly transfer of roughly $192 and get a few extra dollars in interest before the end of the year.

The 52 week savings challenge is great for learning about budgeting and building cash reserves. Overall, it’s an easy way to boost your financial confidence.

How to start the 52 week savings challenge

Starting the 52 week money savings challenge is possible with four easy steps.

Step 1: Setting savings goals

The first step is to figure out what you’re saving for. Having a goal in mind will make it easier to keep saving, even on the weeks you don’t want to. The standard 52 week savings challenge that gets you nearly $1,400 at the end of one year is great for starting an emergency fund.

You can also set benchmarks to reward yourself after hitting key milestones, such as 13 weeks of consecutive savings. Also, a calendar reminder to do the actual transfer can be handy.

Even if you already have an emergency fund, you can still use the 52 week plan to set aside money to invest toward your retirement, such as funding a Roth or traditional individual retirement account (IRA).

Step 2: Set up your account

The second step is figuring out where you’ll store your money. Ideally, this account pays interest, such as a savings account or cash account, and is somewhere you will not see daily (i.e., when you log in to your checking account). Having it tucked away means you're less likely to use it before the challenge ends.

Step 3: Start saving

Now it’s time to do the saving. Ideally, you can set up automatic transfers that'll put the money into an account without any effort from you. However, if you’re going the conventional route, where the weekly amount increases every week, you might have to do the transfers manually.

Set a day that'll be the same for each week you make the transfer. Then set calendar reminders or notifications to remind you to make the weekly transfer. As you go, you can make the necessary adjustments, adding to the weekly account if you can, as you find more ways to make money.

Step 4: Keep going

After doing the 52 week challenge, you can keep going with your other savings goals. Either create a new customized savings plan or continue with your 52 week savings plan. The standard 52 week savings plan will get you a nice cash reserve.

Tip: Channel the momentum from the challenge into building other money-saving habits, such as new savings goals, automating your finances, or saving for retirement.

Customizing your 52 week savings challenge

One of the nice things about the 52 week savings challenge as a savings plan is that you can tailor it to your needs or goals. That is, if you’re looking to save for a vacation or home down payment, you can still use the 52 week plan.

The 52 week money savings plan doesn’t have to include an increasing amount each week. It can be a fixed amount, such as $25 — depending on the amount you need to save.

For example, if you need $5,500 for a major remodeling project in a year, you must calculate the money needed each week and the amount you’ll need to increase it by. In this instance, your week 1 savings goal will increase to $4, and then you’ll increase your savings goal by $4 each week.

With this customized 52 week challenge, you’d see the following savings at four check points:

- ¼ way through (week 13): deposit $52, total savings = $364

- ½ way through (week 26): deposit of $104, total savings = $1,404

- ¾ way through (week 39): deposit $156, total savings = $3,120.

- GOAL: (week 52) deposit $208, total savings = $5,512.

The 52 week challenge can also be adjusted further depending on your goals or financial habits. For instance, you can also start with the highest amount and deposit a decreasing amount each week. Or you can choose to deposit the same amount every week.

This automates your savings. To get the same amount as the standard 52 week challenge, you’d need to deposit $26.50 per week. This allows you to create automatic transfers and enables you to avoid worrying about different transfer amounts each week.

Either way, personalization means you’re more likely to stick to savings goals. Overall, the details of your savings goals won’t matter if you can’t stick to the goals. With that, don’t set goals that are too ambitious, meaning you won’t be able to stick to them and have to abandon them halfway through.

But don’t be afraid to set savings goals that force you to think twice about your spending. Really, there are endless versions of the 52 week challenge that'll get the ball rolling.

Where to stash your savings

Where you keep your 52 week savings should follow two key requirements: put it in an account separate from your everyday accounts. And two, make sure you’re getting a return on that money.

Having different accounts for different goals is a great way to ensure you don’t tap into your savings accounts. Accounts that are somewhat away from your everyday banking or checking accounts will also prevent you from easily transferring cash out of your savings.

Solid returns with limited risk

For anyone trying to save more money in 2022, the 52 week money challenge is a simple and effective way to stay on track. And at the end of the year, you'll have $1,378 extra to bulk up your emergency savings or put toward a savings goal. Using Tellus can get you there faster! Click here to learn more.