BRRRR Method for Real Estate Investing Beginners

Learn the fundamentals about this popular real estate investment method known as BRRRR.

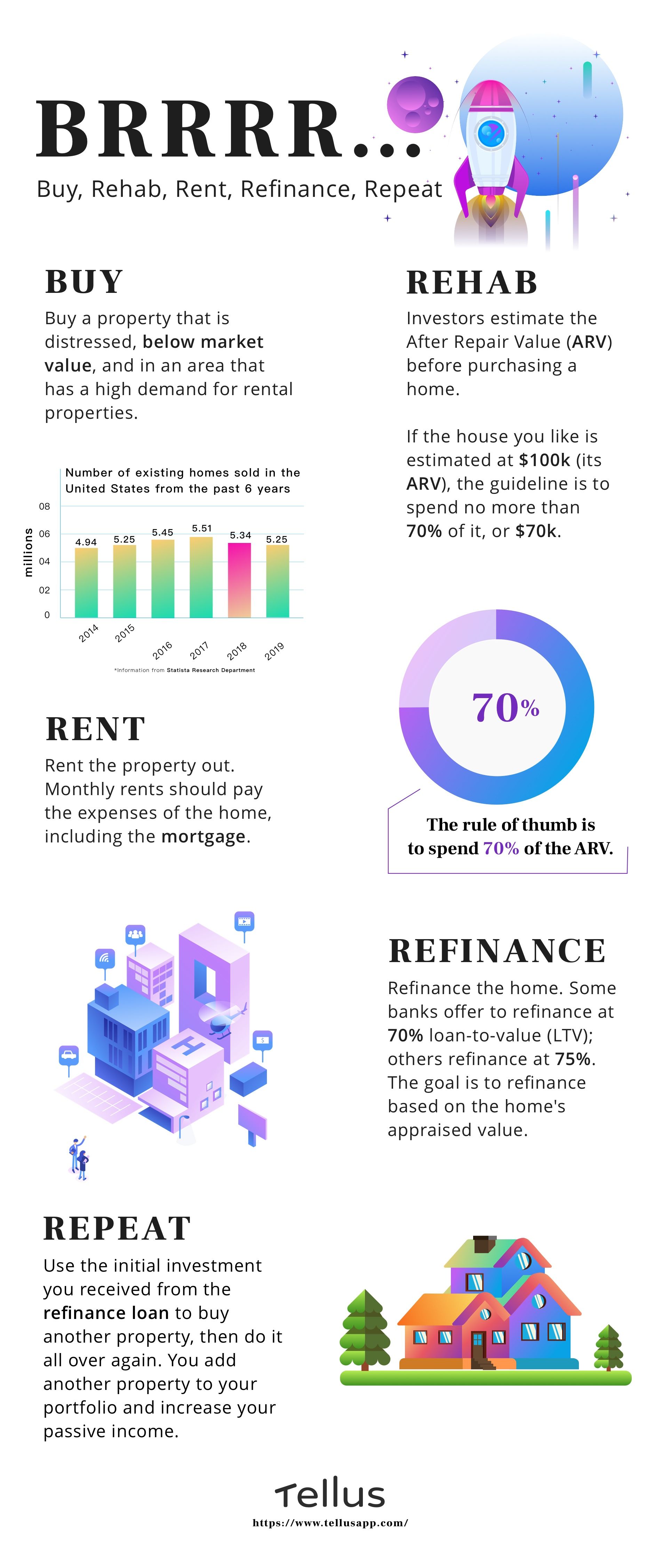

Buy, Rehab, Rent, Refinance, Repeat—better known by the acronym BRRRR—is a popular strategy used by real estate investors. Success stories of people achieving financial independence after implementing BRRRR are inspiring to would-be investors who hope to grow their wealth, but what exactly is it and why is the BRRRR method for real estate investing so popular?

The BRRRR method follows an ordered sequence of steps for transforming a fixer-upper into a top-performing rental property: buy, rehab, rent, refinance, and repeat. The goal is to grow one's net worth by buying multiple properties that each maintain a positive cash flow. Successful execution of BRRRR can earn investors a stream of passive income for many years. This buy and hold method differs from flips, a strategy in which properties are rehabbed and sold for immediate profits. As it is true with any exciting venture, there are risks, so you should understand the fundamentals to ensure satisfying returns. This brings us to the first stage of the BRRRR method: buy.

Buy

You have to spend money to make money, and buying a home that requires renovations is the first step of BRRRR. Distressed properties are cheap, but they are expected to substantially appreciate in value after repairs—as long as you do your homework. Smart investors research the local market and build relationships with professionals experienced in distressed houses. They scour lists of prospective homes to get the deal that guarantees profits. Typically, these properties are below market value and in an area with a strong price-to-rent ratio.

Imagine that you narrowed your search down to a single house and wondered about the maximum price you should pay for it to make a good profit. There is a rule of thumb that investors use when buying distressed properties known as the 70% Rule. It calculates the maximum amount an investor should pay for a given property. The two factors in the formula are the percentage figure and the After Repair Value (ARV). The ARV is an estimated value of a distressed property after improvements. You take the product of those two numbers and subtract the repair costs from it to get the maximum allowable offer (MAO).

After Repair Value (ARV) x .7 - Repair Costs = Maximum Allowable Offer

Tellus Tip

The 70% Rule is just a guideline. However, it serves as a great starting point for a quick screening of a project before moving forward with it and running a detailed expense analysis. The percentage can be adjusted (.7, .75, etc.) to reflect unique scenarios.

Another way to look at the ARV is to add acquisition and rehab costs to get the “all-in” total you should spend on the project. In our example, this would be 70% of the ARV; we will discuss the role of the percentage in the refinance stage. The ARV is key because it helps you evaluate if your BRRRR project will be profitable. It is a guideline that sets the upper limit of your expenses, so that when it is time to refinance the home, you can recover all of your capital from the house and reinvest it.

And how do you estimate a property’s ARV? Real estate valuation is an educated guess; you approximate a home’s value after looking at comparable properties and past market information. But the future is unpredictable. You may receive an appraised value that is less than the estimated ARV. To diminish this risk, use a network of trusted professionals who understand the local market and make a conservative estimate.

Rehab

Continuing from our previous example, let's imagine that after extensive research and running numbers, you purchased the distressed property at the best possible price. Your next step is to rehab the house to build equity. The hypothetical house has a few issues, but you are prepared. You concentrate on value-adds by replacing the leaky roof, fixing the non-functional kitchen, and adding an additional bedroom. To drive up the value even more, you invest in landscaping, basement renovations, and hardwood floor refinishing.

Beyond simply making a property livable, rehabbing helps to increase the returns from the property through forced appreciation. Forced appreciation occurs when you increase the value of a property through your actions, such as increasing the monthly rent, making repairs, adding a third bedroom, and updating amenities. At the rehab stage, you want to ignore unnecessary luxury items, such as granite countertops, and choose amenities and finishes that are equivalent to those in neighboring homes.

Related: Understanding Real Estate Appreciation

Rent

After rehabbing a property, you need tenants to pay the rent. In the buy stage, we recommended looking for prospective rental properties in markets with a strong price-to-rent ratio. In the U.S., they tend to be in locations that experience strong economic growth, low housing prices, and high demand for rental properties. These locations are strong BRRRR candidates. For example, a large city in the San Francisco Bay Area is a difficult area for the BRRRR method to succeed. While in a mid-sized town in Texas, you may have better results. Price-to-rent ratios matter because the goal is to charge rent that covers the rental property’s operating expenses plus the mortgage, if any, to produce a positive cash flow.

But how do you decide how much rent to charge? The rent price roughly correlates to the price of the house. Generally, monthly rents that generate positive cash flow are at least 1% of the property’s final price, which is why there is another rule of thumb that investors use to help them evaluate a property. It is called the 1% Rule. Some investors go by the 2% rule. To determine if the rent price can sustain a positive cash flow, take the monthly rent divided by the value of the property. If the result is 1% or higher, you’re looking at a profitable deal.

Tellus Tip

The 1% rule is used for quick estimates. Ideally, you will look at comparable properties in your market. To research rent prices, look through listing services, contact properties that are advertising available units, and connect with property managers.

Related: The Best (and Worst) Ways to Collect Rent

Refinance

A successful BRRRR strategy hinges on the ability to refinance a property because an investor’s objective is to get back their initial investment to reinvest in other properties. Recall that in our hypothetical scenario, you purchased a distressed house and determined the after repair value and rehab costs. Now imagine you also knew that your bank offers 75% loan-to-value (LTV) refinancing. LTV is a term used by lenders to describe the ratio of the loan to the value of the asset. You begin the process of refinancing and learn that the appraised value of your renovated house is more than your estimated ARV.

The good news makes you confident that you will pull out all of your money from the deal. Throughout the process up to this moment, you managed to keep expenses within 70% of the estimated value of the house. And after refinancing, you completed an important objective of BRRRR: recovering most, if not all, of your capital, because the refinance loan was based on the appraised value. With the capital back in your hands, you are ready to repeat the cycle all over again.

Tellus Tip

There may be a seasoning period of 6–12 months before a homeowner can refinance. Seasoning period in real estate refers to the length of time a homeowner must own a property. Periods vary among lenders.

Related: Real Estate Finance Terms for Beginners

Repeat

After successfully refinancing the house and recouping both the acquisition and repair costs from the new loan, an investor is ready to implement BRRRR all over again. The repeat stage is where you should apply everything that you have learned and use it to improve your system.

Let’s review the stages with a BRRRR method example using simple math.

You researched a market in Texas and found the distressed property of your dreams. You ran quick and dirty numbers in your head using a few rules of thumb before deciding to move forward with further analysis. You determined the home’s ARV of $150,000, rehab costs of $20,000, and the maximum allowable offer for the property based on an all-in amount equal to 70% of the ARV.

After Repair Value (ARV) x .7 - Repair Costs = Maximum Allowable Offer

$150,000 x .7 - $20,000 = $85,000

You decide to spend no more than 70% of the ARV, which means that your acquisition and rehab costs should not exceed $105,000—and you did not. After your offer of $80,000 was accepted ($5,000 less than the MAO), your all-in cost is just only $100,000.

Now it’s time to rent out the property. In this particular area of Texas, rental properties comparable to yours rent for $1,500 a month. The cost of running your rental property is $200, and this allows you to earn a positive cash flow of $1,300.

After a seasoning period of 6 months, you start the refinancing process. Your home was appraised for $160,000 and the bank offers you 75% LTV.

$160,000 x .75 = $120,000

Your initial investment is $100,000.

$120,000 - $100,000 = $20,000

Your initial investment of $100,000 earned you $20,000 more in capital; money was not left in the property. With the new mortgage cost of $700, you still see a decent cash flow of $600 a month. Furthermore, your net worth increased by $60,000 after subtracting your all-in cost of $100,000 from the appraised value of $160,000. With the additional $20,000 in capital for reinvesting, you begin the cycle again by finding a new stream of long-term income from a second rental property.

Final Word

Is the BRRRR method for real estate investing for you? The BRRRR method is a solid strategy to build wealth and a vast real estate investment portfolio. Advocates believe it is the most efficient way to invest in real estate, and they may be right. There are dozens of helpful books, podcasts, and forums dedicated to helping prospective investors excited about BRRRR. But the BRRRR method is more than just adding another property to a portfolio. You are working towards becoming a landlord.

Property management can be a full-time job and the cash flow from your property will go towards the expenses of operating it, like maintenance, to keep tenants happy. After all, although BRRRR offers the exhilaration of building wealth, it is built upon the philosophy of buying and holding property. Thus, a successful BRRRR property is one that not only maintains a positive cash flow, but also wins long-term renting from loyal tenants and lifelong security for a comfortable retirement.

To put your rental properties on autopilot, try using the Tellus app. Collect rent online, chat with tenants, and let technology automate the rental experience.