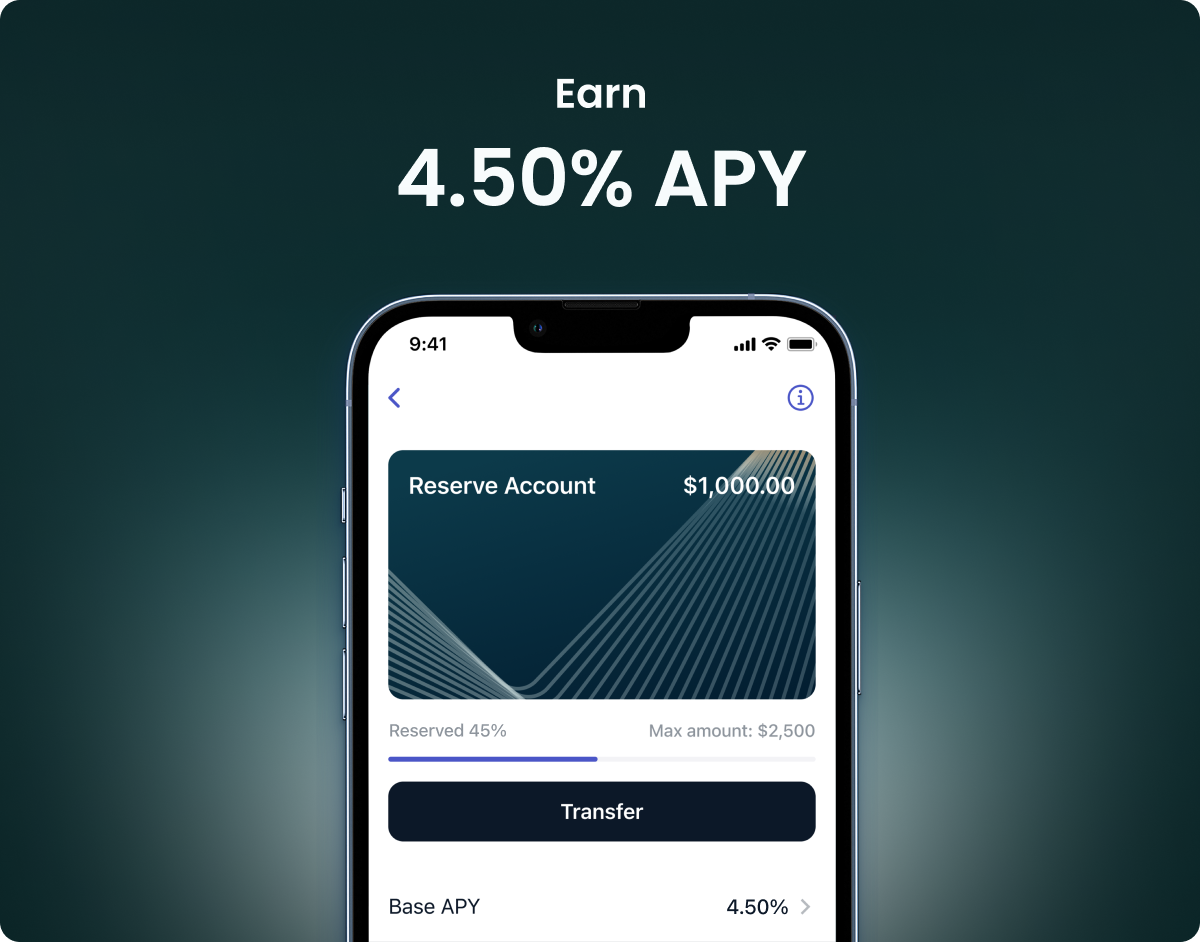

Brand new Reserve Account. 4.50% APY.

Get excited, it’s here - 4.50% APY, everyday, with the brand new Reserve Account. Jump start your savings journey with a supercharged rate on up to $2,500.

How’s it different from the Boost Account? Here are the highlights:

Fixed 4.50% APY

The Reserve Account steps it up so you get the most out of every dollar you save.

The ace up your sleeve

The Reserve Account is limited to $2,500, allowing us to offer the highest possible rate to help your money ramp up quickly.

On top of that, you’re still getting all of the functionality you love about Tellus.

Cash rewards paid daily

Reserve Account pays what you earn daily. It’s your money. Earn more and get it faster.

No lockup

Your cash is free to move when you need it. No lockup. No nonsense. 100% liquid, everyday.

No fees†

Not much more to say about it. Tons of value that costs you nothing.

Make recurring transfers

Put your savings on auto-pilot by setting recurring transfers directly from your bank into your Reserve Account.

Bank-grade security‡

Rest easy with AES 256 encryption protecting your data.

Download the app to get your Reserve Account.

FAQs

What is the Reserve Account?

The Reserve Account earns a rate of 4.50% on balances up to $2,500, and pays out daily. Zero fees. Zero lockup period.

Why should I use the Reserve Account?

The Reserve Account is designed with a hands-off approach in mind. Add money and earn interest. That’s all.

How many bank accounts can I link to my Boost or Reserve Accounts?

Only one bank account may be linked to your Tellus Account. This includes both the Boost and Reserve Accounts.

How does the Reserve Account cap work?

Your Reserve Account can have a balance up to $2,500 (the “cap”). Once this limit is reached, any cash rewards earned are automatically transferred to your Tellus Boost Account.

How do daily payments work?

Cash rewards are automatically added to your Reserve Account every day at 12 AM PST. If a payment would result in a balance that exceeds the account limit, the excess cash is transferred to your Boost Account.

Where do I find the Reserve Account?

You’ll be able to access the Reserve Account from the Tellus app once you have the latest version installed. You’ll see more information on the home screen.

When can I withdraw my money?

You are free to make withdrawals as soon as your transfers have successfully been processed. This may take 7 business days, although in many cases, your transfer could process as quickly as a day or two.

Disclosures

† Tellus is not a bank. Tellus is not FDIC insured. There are no fees for opening or using Tellus; however, your bank may charge fees based on their terms of service. Payment solutions are provided by Stripe and Plaid.

‡ “Bank-level” means that user data is encrypted and protected using the same industry-leading, or better, encryption standard that banks use.